Return on Equity - Meaning/ Definition

Return on Equity (ROE) / Net Worth (RONW)’ is a financial relationship. It measures what a company earned as a profit on its equity capital or net worth.

Profit in this definition means the net profit after paying the income tax. 'Profit After Tax (PAT)' is another name for net profit.

Equity capital here does not mean just the amount of equity share capital. It also includes the reserves (profits accumulated over the years). This total equity share capital and reserves is also called the ‘Net Worth’. This is also called 'shareholders’ funds'. Thus net worth is the sum of equity capital and reserves. It belongs to the equity shareholders. Shareholders here mean the ordinary or common or equity shareholders.

The profit a company earns employing its net worth in the business is the return on equity. It is a percentage. It is the percentage of profit the company earns on its net worth.

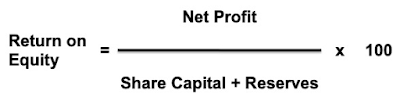

Return on Equity - Formula

We calculate return on equity by dividing the net profits by the net worth. Please see the formula:

A beginner wonders which net worth figure to use. Should we use the net worth standing at the beginning of the year or at the end? A company employs only the funds available at the beginning of the year. Therefore it is fitting to use only the net worth standing at the beginning of the year. I use the net worth number standing at the beginning of the year. Now let us see an example for calculating the return on equity.

Example

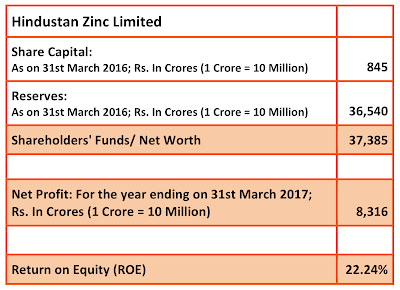

I use the financial statements of 'Hindustan Zinc Limited' for my example.

Please note that I have used the net worth figure standing on the 31st March 2016. Whereas I have used the profit earned during the financial year 1st April 2016 to 31st March 2017.

Why Return on Equity is Important?

Return on equity is very important for an investor. This is because ROE measures how efficiently a company uses its capital to generate profits. It indirectly measures at what rate your investment is likely to grow in the long term. As I have already emphasised many times before, the miracle of compounding is the real trick behind successful investing. In fact, all investing.

Let us consider the following example to understand this concept.

Two companies A and B are available for purchase for a lakh (hundred thousand). While Company A has an ROE of 15% per annum Company B gives 7.5%. Let us see how they fare over a long investment period of 35 years.

If you observe carefully the difference between the two companies was narrow after five years (Rs.2,31,306 of Company A versus Rs.1,54,330 of Company B). However, the gap widened dramatically over a long period of 35 years. This is the result of the working of the compound interest principle.

How Does this Matter to the Investor?

You may be wondering why small investors like you and I should care about all this. Well, it seriously concerns us and our investment. Suppose you had bought Company A for rupees one lakh 35 years ago. This means you paid a price equal to one time the net worth of the company. Further, suppose you want to sell the company now. Let us assume that the buyer is willing to pay you as per the same formula of one time the net worth of the company. You will end up receiving a sum of rupees 153.15 crores. Whereas your neighbour had purchased Company B at the same time for the same price of a lakh of rupees. Now he too sold his company and got the compensation as per the same formula. He will end up receiving just rupees twelve crores.

We just assumed that the market had offered only one time the net worth (price to book value for all the shares of the company). However, we know very well that often stock markets are highly enthusiastic and offer even three to five times the book value. If the market offers five times the net worth of the company you would end up encashing your investment of just a lakh of rupees at rupee 765 crores!

So would you buy Company A or Company B? Do you realize the importance of return on equity in the area of investing?