Investors are curious to know at the beginning of every month what stocks to buy. They are looking to experts for credible stock tips/ stock recommendations. Stock News is filled with innumerable stock tips whose credibility is suspect. In order to quench the genuine thirst of the investors to know what stocks to buy, every month I communicate the best stock picks for the month, in which I have personally invested, companies which have a sustainable business model.

This month we have liberalized the rules for buying stocks a bit.

Why?

The market is sizzling and making stocks highly expensive across the board, and if we don’t loosen a bit we will not be able to:

- Buy anything

- Do justice to some of the good stocks that had suffered price hammering in the global commodity markets.

We have set a liberalised yet strict rules such that besides being a member of our ‘Portfolio 2K15’, the stocks shall satisfy the three criteria prescribed below:

- The Price to Book Value (P2BV) Ratio shall be less than 1.50. This means we will allocate money to a stock under this rule to only those stocks that are available at or at a discount to the price to book value ratio of 1.50. This is liberalization from a stringent 1.00 earlier.

- The Price to Earnings (PE) Ratio shall be below 15. This is again liberalization from the tough hurdle of 10 earlier.

- The product/ combination of PE*P2BV shall be less than 22.50 (1.5*15)

- The Dividend Yield shall be more than 0%. However, a mere good dividend yield is not sufficient. In addition, the stock must have passed at least one of the three previous tests. Meaning if the share proves expensive under the P2BV, PE and PE*P2BVcriteria, it is ineligible for allocation merely on the grounds of an attractive dividend yield.

The total investable sum is taken as multiples of 10,000, that is Rs.20,000, 40,000 or 120,000 and so on, depending on the investible surplus available with the investor.

The basic unit of 10,000 is equally distributed among the four criteria at Rs.2,500 each or multiples thereof.

Summary of Stocks to Buy

This August 2017 all the stocks constituting our Portfolio 2K15 qualified, however MOIL Ltd., though managed to qualify after many months, could not earn enough allocation even to buy a single share!

Stock Analysis Based on Price to Book Value Ratio

Let us examine the eligible candidates separately under each

of the three criteria in detail Price to

Book Value (P2BV) Ratio:

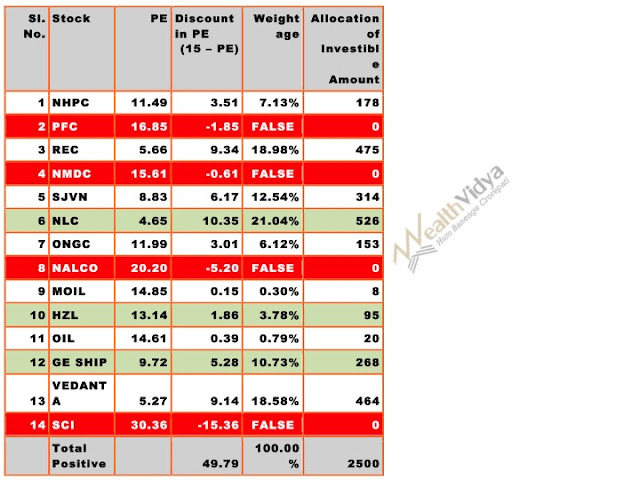

Stock Analysis Based on Price to Earnings Ratio

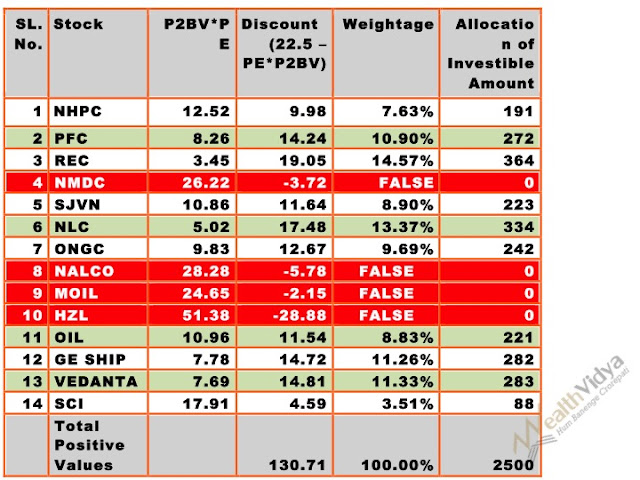

Stock Recommendation Based on PE x P2BV Criterion

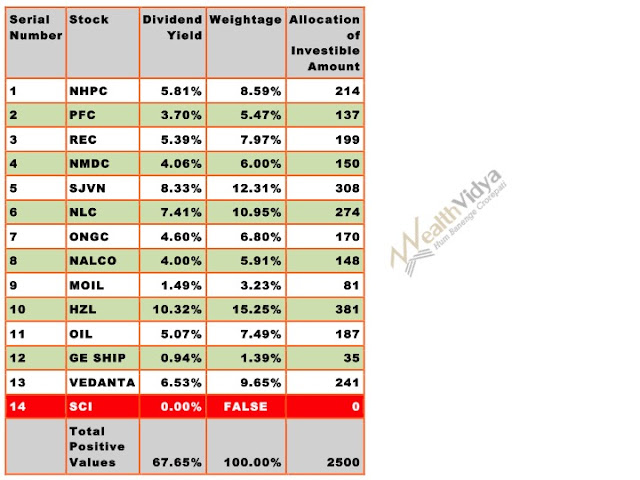

Stock Pick Based on Dividend Yield Criterion

Conclusion

In conclusion the answer to the question what stocks to buy this August 2017 is that the above described 13 stocks constitute the credible stock recommendations from my side that can be bought

in the month of August 2017. MOIL Ltd., though qualified could not muster enough

allocation even for buying a single share.