Actual Question:

Answer:

Dear Friend!

I don’t know from where

you got the number INR.15800 with reference to Eicher Motors Ltd.’s share. The

current price is Rs.29,180 a piece.

Of course the price of

the share has been rising continuously and has risen by about Rs.6000 (about

26%) in a span of just three months.

The reason for the

continuous price is the bullish ‘Buy’ calls given by almost every

brokerage in the country with great company performance expectations.

But, is all this

euphoria really justified?

Is it fair to expect the

company to deliver performance in exact synch with market expectations?

There is no doubt that

Eicher Motors is a wonderful company, but while the share price can soar 26% in

three months easily, it is impossible to deliver rise in the turnover and

profits 26% in three months!

Please look at the graph

below:

You can see how

dramatically the gap between the EPS and Price Rise is widening.

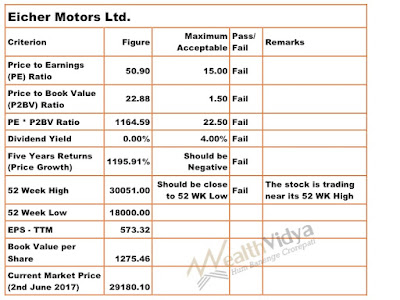

Now let us focus whether

the Eicher Motors share is in the buy zone as per value

investing norms.

We can see that Eicher

Motor’s share is very, very expensive and unaffordable. It is not wise to

invest in any share at such high valuations.

Please note that it is

not the fault of the company - it is the market’s fault. The company is

delivering excellent results, but the market is unjustifiably enthusiastic.

In conclusion the galloping price of Eicher Motors Ltd.'s share price is entirely unjustified and unsustainable and imposes an unfair burden on the company to ever deliver superlative performance.

Suggested Further Reading:

Suggested Further Reading:

- Margin of Safety

- How to Calculate the Intrinsic Value Shares?

- You Only Find Out Who is Swimming Naked When The Tide Goes Out - Warren Buffett’s Quote

With Best Regards,

Anand