Actual Question:

Companies A,B, C with Share Price 40 each and EPS is 2,4,10 respectively

which one is better to invest and Why? Considering EPS is the only Factor.

Answer:

Dear Friend!

Thank you for the nice question.

Earnings Per Share (EPS) is one of the key parameter on

which companies can be evaluated both individually as well as relatively.

However absolute figures of EPS are not readily comparable

when the share prices are different. Luckily in your question you have kept the

prices constant. Therefore, from the earnings per share and the market price we

should draw a ver crucial as well as readily comparable information called the

‘Price to Earnings (PE) Ratio’.

The PE Ratio is obtained by dividing the current market

price (CMP) by EPS. The PE Ratio as per standard value investing practices

shall be any positive number that is below 15. Lower this number better it is.

It should not be negative as only a negative EPS can yield a negative PE Ratio

and a negative EPS menas the company has suffered a loss.

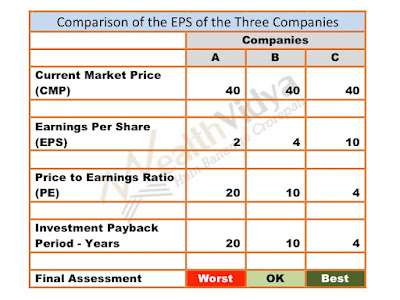

Now lets calculate the PE Ratios of all the three companies.

It is evident from the above table that company C has the

lowest positive PE ratio and therefore is the best. The PE Ratio of company B

is below 15 and standing at 10 which is perfectly alright. Company A with a

score of 20 (over 15) is the worst and therefore shall be rejected.

Incidentally the PE ratio also indicates in how many years

the company earns back our investment. Therefore the lowest number is the best.

Company C earns back the investment in four years (an ROI of 25%) which is wonderful.

One year EPS and PE Ratio can be by fluke and therefore

misleading. therefore the PE Ratio computed from the average EPS of the last

five years or the latest year, whichever is lower shall be considered.

Please note that besides the price to earnings ratio, for a

thorough evaluation of a company, there are many more parameters that need to

be considered. Following are some of the parameters:

- Price to Book Value

- Dividend Yield

- No or low indebtedness

- Distance from 52 week high

- Last five year share price returns

In conclusion best company can be selected from the EPS and price information by computing the price to earnings ratio. Many other techniques also shall be employed complementary to the PE Ratio.

Thank you,

With Best Regards,