Yes, certainly it is a good idea to buy

shares of companies that have announced issue of bonus shares.

But there is a very big and important

“IF” attached.

What is and why is the big “IF”?

The company that has announced the bonus

MUST:

- Have been thoroughly investigated by you before hand, it meets all the stringent value investing norms. It should already finding a place in your portfolio. This means that you cannot buy a tom-dick-and-harry stock just because a bonus has been declared.

- Currently the price must be reasonable and the stock must be trading / available at a fair price/ valuation - that is you will be willing to buy the stock even if there was no bonus issue.

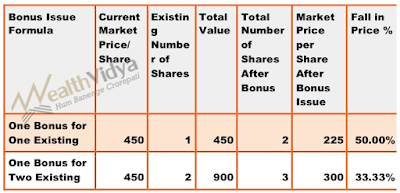

After having bought the shares be prepared

to witness a sharp fall in the market price of the share you just bought, after

the ex-bonus dates. The fall in the price will be proportional to scheme of

bonus issue. Suppose it is one bonus share for one existing share, the price

will halve. If is it is one bonus share for two existing shares, the price will

fall 33.33 %. Please see the following table:

Reason for the fall is that when bonus

shares are issued the book value per share will fall, and since the

price has relationship to the book value per share, the price too falls.

Finally, due to some inexplicable reasons

the share price of good companies, after the steep fall, starts regaining its

original price, before the bonus issue. Please see the following price graph of

Rural Electrification Corporation which became ex-bonus on 28th September 2016:

Before becoming ex-bonus the share was

trading at Rs.249.15. After becoming ex-bonus it had fallen to Rs.122.20. Again

it started gaining and reached a high of Rs.220.55 in May 2017, a near 100%

recovery.

In conclusion, yes, certainly it is a

good idea to buy shares of otherwise excellent companies that have announced

issue of bonus shares. The price will fall and recover the loss. You double the

value of investment as well as dividends for many years in future.

I have done it and have profited from it.

Thank you,

With best regards,

Anand