I present here the glorious Indian stocks to buy this August 2018. Only this morning I invested Rs.10,000 in these stocks. You can invest in them too.

All the 20 stocks both from the existing 'Portfolio 2K15' as well as the new finds were ordered into four grades “A” to “D” and “Rejected/ Not Analysed”. The classification is primarily based on the ROE. I tinkered with and redefined the rules of grouping. The status of the 20 stocks and their grading is depicted below:

The Rules of Grading

Glorious Indian stocks to buy this August 2018: Grade A

- Average ROE for the last 14 years is greater than or equal to 20% and

- The ROE for the year 2017 is greater than or equal to 5% but lesser than 8%

Grade B

- Average ROE for the last 14 years is greater than or equal to 15% and

- The ROE for the year 2017 is greater than or equal to 5%

Grade C

- Average ROE for the last 14 years is greater than or equal to 10% but less than 15% and

- The ROE for the year 2017 is greater than or equal to 10%

Grade D

- Average ROE for the last 14 years is less over 0%

Distribution of Investible Sum

The investible sum of Rs,10,000/- was distributed to the four groups as follows:

- Grade A: Rs.7,015/-

- The Grade B: Rs.1.343/-

- Grade C: Rs.1,194/-

- Grade D: Rs.448/-

You can see that ‘Grade A‘ commands the lion’s share of the sum of Rs.2000 – a whopping 70.15%. This is because of two reasons. The high ROE generated by the scrips of over 20% per annum, consistently for over 14 years. Further, there are seven stocks out of a total of 17 that have made it to this grade. Thus based on the number of scrips Grade A grabbed 41.18% (7*100/17).

Following table depicts the allocation based on grades, the number of scrips falling in the grades and the combined (multiplied, for in mathematics combined means a product and not an addition or sum):

Glorious Indian Stocks to Buy this August 2018: Norms Selection, Rejection and Distributing the Investible Sum

In my new

scheme of things following are the measures for allocating the investment:

- 14 Year Average ROE %: 20% of the investible sum, Rs.2000

- The financial year 2017 ROE %: 20%, Rs.2000

- Price to Book Value Ratio (P2BV): 20%, Rs.2000

- Price to Earnings (PE) Ratio: 20%, Rs.2000

- Dividend Yield: 20%, Rs.2000

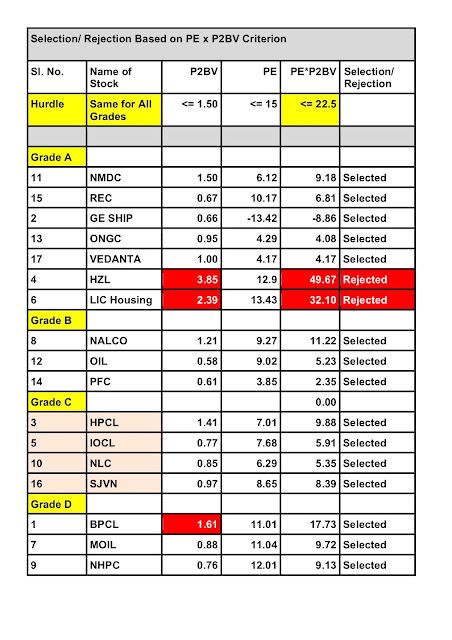

The combined ‘Price to Earnings and Price

to Book Value’ ratio is only used to determine whether a stock is expensive. I

have not made any allocation of money under this norm. If a stock fails this

test (PE*P2BV Ratio shall be less than 22.50), then the stock is expensive and

is eliminated. No allocation of investment is made to the stock. For example,

even though Hindustan Zinc and LIC Housing Finance had made it to Grade A, I

have eliminated them. Their combined ratios stand at 49.67 and

32.10 respectively.

On the other hand, if a stock fails under any

other criterion it simply will not get any allocation under that criterion. It

will not be totally eliminated. For example, the Great Eastern Shipping Company

Ltd.’s PE ration on 1st August 2018 was 28.42, more than the permissible 15.

Its dividend yield on that day was 2.38%, below the minimum permissible 4%.

Still, I did not totally eliminate it. Please observe the following table

for selection/ rejection based on the combined ‘PE*P2BV Ratio’ criterion:

Glorious Indian Stocks to Buy this August 2018: Summary of Allocation and Number of Stocks to Buy

Finally, after allocating

Rs.10,000/- as described above we get the summarised results as depicted in the

following picture:

Allocation Based on 14 Year Average ROE

I present here the distribution

of Rs.2,000 among various stocks based on the '14

Year Average ROE Criterion':

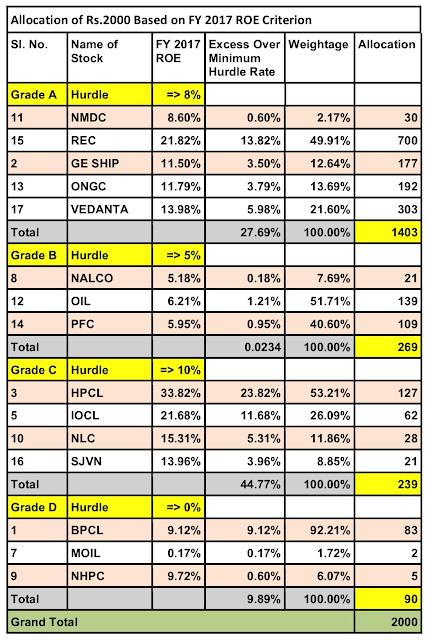

Allocation Based on Financial Year 2017 ROE

I show the distribution of the

next Rs.2000 investment based on the ‘Financial Year 2017 ROE’ criterion in the

following table:

Glorious Indian Stocks to Buy this August 2018: Allocation Based on Price to Book Value Ratio

I have worked the distribution

of the next Rs.2000 based on the price to book value ratio as follows:

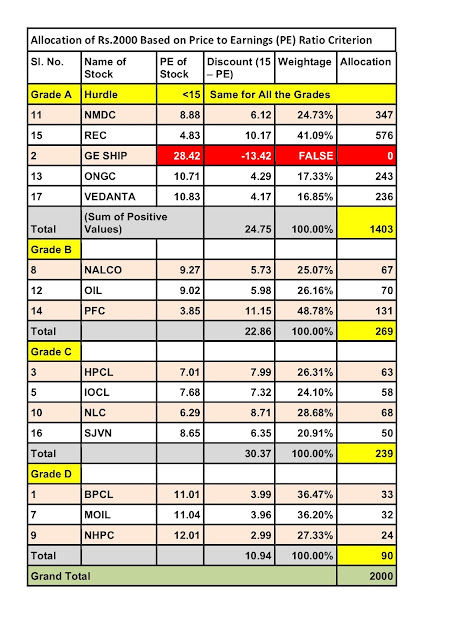

Allocation Based on Price to Earnings Ratio

Glorious Indian Stocks to Buy this August 2018: Allocation Based on Dividend Criterion

I present below the fifth and

the last Rs.2000 of investment based on the dividend

yield criterion.

Conclusion

These are the ‘Glorious Indian Stocks to Buy this August 2018‘.

I have invested my Rs.10000 in the same stocks, exactly in the same proportion.

You too can safely invest and benefit from the investment over a very long

period of time. Happy investing!

A round of applause for your blog article.Thanks Again. Awesome.

ReplyDeleteclipping path service|Background Removal service|Vector Tracing