Company history and business:

PTL Enterprises Limited

(PTL) is an associate

company of Apollo Tyres which acquired

the manufacturing facility of Premier

Tyres and Tubes. Presently the manufacturing plant has been leased to

Apollo Tyres and the company earns only a fixed lease rental income from its tyre

plant.

The

company has entered into healthcare business as the holding company of Artemis

health Sciences, the company that operates popular hospitals under the brand Artemis. Today major revenue is derived only from the healthcare business and accrues to PTL only out of consolidation of the financial statements.

PTL

is listed on the Bombay and Cochin stock exchanges.

Mr.Onkar

S Kanar, Chairman and Promoter of Apollo Tyres is also the Chairman of PTL.

|

| Artemis Health Sciences Company Logo which is the subsidiary of PTL Enterprises |

|

| Artemis Hospital operated by Artemis Health Sciences, a subsidiary of PTL Enterprises |

Basic Filtering Criteria:

|

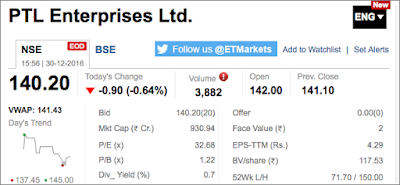

| PTL Enterprises Share's Market Snapshot |

(Rs. Crore/ Rs. 10 million)

|

Minimum Required

|

Actual

|

||

1

|

Turnover

|

1000

|

449.83

|

Fail

|

2

|

Market Capitalization

|

1000

|

930.94

|

Fails Narrowly

|

3

|

Price to Earnings Ratio

|

Less than 15

|

32.68

|

Fail

|

4

|

Price to Book Value

|

Less than 1.5

|

1.22

|

Pass

|

5

|

Dividend Yield

|

4-5%

|

0.70%

|

Fail

|

As

per basic value investing filtering criteria the PTL Enterprises’ share shall

be dropped forth with as it passes only one out of the five filtering criteria,

still we shall carry out a limited further evaluation the scrip.

A. Company Performance

Profitability Analysis

PTL Enterprises Ltd.

Consolidated Profit & Loss Account (Rs. Crore/ Rs. 10 million)

|

Mar ' 16

|

Mar ' 15

|

Revenue from Operations

|

449.83

|

410.42

|

Cost of materials

|

105.34

|

99.91

|

Changes in Inventory of WIP and FG

|

1.06

|

-1.87

|

Employee Costs

|

74.28

|

65.77

|

Other Expenses

|

185.61

|

172.93

|

Total Operating Expenses

|

366.29

|

336.74

|

EBDITA

|

83.54

|

73.68

|

Depreciation

|

13.22

|

13.54

|

Finance Costs

|

13.82

|

20.06

|

Earnings Before Tax (EBT)

|

56.50

|

40.08

|

Non-Operating Income

|

8.30

|

4.22

|

Profit Before Tax (PBT)

|

64.80

|

44.30

|

Tax Expenses

|

19.29

|

10.77

|

Profit After Tax (PAT)

|

45.51

|

33.53

|

EBDITA Margin - % of Sales

|

18.57%

|

17.95%

|

Interest Cost - % of Sa;es

|

3.07%

|

4.89%

|

EBT Margin - % of Sales

|

12.56%

|

9.77%

|

PBT Margin - % of Sales

|

14.41%

|

10.79%

|

PAT Margin - % of Sales

|

10.12%

|

8.17%

|

Highlights:

EBDITA, EBT and PAT margins are decent

but nothing to boast about.

Interest cost is significantly high.

On this parameter the company’s performance is satisfactory.

Balance Sheet Analysis

PTL Enterprises Ltd.

Consolidated Balance Sheet (Rs. Crore/ Rs. 10 million)

|

Mar ' 2016

|

Mar ' 2015

|

LIBILITIES

|

||

Share Capital

|

13.24

|

13.24

|

Reserves and Surplus

|

764.68

|

143.81

|

Total Net Worth

|

777.92

|

157.05

|

Long-term Borrowings

|

49.62

|

69.00

|

Other

Long-term Liabilities

|

55.59

|

44.45

|

Long-term

Provisions

|

20.24

|

19.09

|

Total Non-Current Liabilities

|

125.46

|

132.54

|

Short-term

Borrowings

|

0.00

|

0.00

|

Trades

Payable

|

63.41

|

56.50

|

Other

Current Liabilities

|

44.03

|

71.47

|

Short-term

Provisions

|

25.24

|

25.74

|

Total Current

Liabilities

|

132.69

|

153.71

|

Total

Liabilities

|

1036.07

|

443.30

|

ASSEST

|

||

Fixed

Assets

|

839.71

|

251.97

|

Capital

Work-in-Progress (CWIP)

|

4.01

|

1.79

|

Total

Fixed Assets

|

843.72

|

253.76

|

Non-Current

Investments

|

0.00

|

0.00

|

Deferred

Tax Assets

|

5.95

|

5.77

|

Long-term

Loans & Advances

|

19.87

|

16.03

|

Other

Non-Current Assets

|

0.00

|

0.14

|

Total

Non-Current Assets

|

25.82

|

21.94

|

Inventories

|

6.07

|

7.13

|

Trade

Receivables

|

54.50

|

39.72

|

Cash

& Cash Equivalents

|

10.09

|

28.48

|

Short-term

Loans & Advances

|

17.54

|

16.38

|

Other

Current Assets

|

4.30

|

1.88

|

Total

Current Assets

|

92.50

|

93.60

|

Intangible

assets

|

2.31

|

2.66

|

Goodwill

on Consolidation

|

71.71

|

71.35

|

Total

Intangible Assets

|

74.02

|

74.01

|

Total Assets

|

1036.06

|

443.30

|

Tangible

Net Worth (TNW)

|

703.90

|

83.04

|

Total

Outside Liabilities

|

1161.53

|

575.84

|

Current

Ratio

|

0.70

|

0.61

|

Long-term

Debt-Equity Ratio

|

0.16

|

0.84

|

Total

Outside Liabilities/ Tangible Net Worth (TOL/ TNW)

|

1.65

|

6.93

|

Highlights:

- Very low current ratio, below the minimum 2 indicates weak liquidity position but since the healthcare business is a cash business, companies tend to deliberately work on negative working capital – that is keeping the current assets low and current liabilities, mainly sundry creditors or trade payables high.

- Long-term debt-equity ratio is good and well below the recommended less than one.

- TOL/ TNW Ratio was very poor in the previous financial year but in 2016 was brought well below the stipulated not more than three.

On this parameter the company’s performance is not satisfactory.

Cash Flow Analysis:

PTL Enterprises Ltd.

Consolidated Cash Flow Statement (Rs. Crore/ Rs. 10 million)

|

Mar ' 2016

|

Mar ' 2015

|

Cash

Flow Statement (Consolidated)

|

||

Net

Cash from Operating Activities

|

65.99

|

79.15

|

Interest

|

-12.44

|

-18.80

|

Adjusted

Net Operating Cash Flows (Free Cash Flows)

|

53.56

|

60.35

|

Purchase

of Fixed Assets & CWIP

|

-23.29

|

-17.07

|

Proceeds

from Sale of Fixed Aseets

|

2.43

|

0.45

|

Fixed

Deposits

|

-0.24

|

4.79

|

Interest

Received

|

3.30

|

1.99

|

Net

Cash Used in Investing Activities

|

-17.80

|

-9.84

|

Long-term

Borrowings

|

48.55

|

0.44

|

Repayment

of Long-term Borrowings

|

-95.34

|

-35.48

|

Payment

of Dividends

|

-7.97

|

-7.74

|

Proportion of free cash

flows distributed as dividends

|

14.87%

|

12.83%

|

Others

|

0.00

|

-0.02

|

Net

Cash Flow from Financing Activities

|

-54.75

|

-42.80

|

Net (Decrease)/ Increase in Cash for the Year

|

-19.00

|

7.71

|

Highlights:

- Small size of free cash flows generated.

- Only a very small portion of free cash flows is being distributed as dividends. Perhaps this is because hospitals business is a capital intensive business and requires large sums of cash to be pumped in for creating new fixed assets.

On

this parameter the company’s performance is not anything laudable.

Dividend Track Record

Year

|

Month

|

Dividend (%)

|

2016

|

May

|

50

|

2015

|

May

|

50

|

2014

|

May

|

50

|

2013

|

May

|

50

|

2012

|

May

|

50

|

2011

|

May

|

50

|

2010

|

May

|

25

|

2009

|

Apr

|

20

|

2008

|

May

|

15

|

Highlights:

- Company has paid uninterrupted dividends at least for the last 9 years.

- Nine years is not a very impressive dividend paying track record.

On

this parameter the company’s performance is not very satisfactory.

Dividend Coverage from non-operating income:

Mar ' 16

|

Mar ' 15

|

Mar ' 14

|

Mar ' 13

|

Mar ' 12

|

|

Dividend

|

6.62

|

6.62

|

6.62

|

6.62

|

6.62

|

Net Non-Operating Income

|

1.4

|

1.53

|

1.14

|

2.49

|

0.77

|

Dividend Coverage from Non-Operating Income

|

21.15%

|

23.11%

|

17.22%

|

37.61%

|

11.63%

|

The above table shows that around 20% of

the dividends distributed by the company come out of non-operating income. Considering

that the size of dividend payout itself is small portion of the consolidated (including

the 10 times more larger Artemis’ contribution), the non-operating income coverage of

dividends is nothing great.

On

this parameter the company’s performance is not impressive.

B. Market Condition:

Price to Earnings Ratio:

At the current market price of Rs.140.20

and Earnings Per Share (EPS) based on trailing quarter time periods method

(TTM) the PE Ratio is 32.68, is well far above the recommended 15 and makes the

scrip highly expensive, that too for a company delivering just average results.

Market condition on this parameter is not

favourable.

Price to Book Value per Share:

With a price to book value ratio at 1.22

the market condition is below the maximum permitted 1.5 and therefore is

favourable.

Market condition on this parameter is

favourable.

Dividend Yield:

Dividend yield

of 0.70% is unacceptable. The low dividend payout by the company as well as the

high price of the share are together responsible for this low dividend yield.

Market condition on this parameter is

unfavourable.

Distance from 52 week high:

The 52-week low for this share is

Rs.71.70 and the distance from 52 week low is 95.54%. In fact the price very

close to the 52-week high of Rs.150.

Market condition on this parameter is

unfavourable.

Five-year price graph:

|

| Picture shows the five-year price movement graph of PTL Enterprises |

The price graph

clearly shows the steep but unjustified market rally in the price of the scrip,

making the share expensive to invest in today.

Five-year share price return:

|

| Picture shows table of five-year price returns of PTL Enterprises Share |

The five-year

return (return measured by change in share price) is 347.92% in the last five

years. This means that the share has already rallied about 3.5 times in the

last five year and presently in a clearly unfavourable zone to buy this share.

On

this parameter the market condition is not favourable.

C. Final Conclusions:

- Company has diversified from tyres into healthcare.

- The company is small-cap and therefore the risks associated with small-cap companies are inherent with this scrip. The turnover small, profit size is small and overall the balance sheet size is very small.

- The profitability ratios are decent but do not justify the high premium market is paying for the scrip because of the healthcare business.

- Balance Sheet ratios are acceptable other than the poor Current Ratio.

- Annual Cash Flows generated are tiny.

- PE Ratio is very high making the scrip highly expensive.

- P2BV Ratio is acceptable.

- Uninterrupted dividend paying track record is not long enough.

- Dividend yield is unacceptably poor.

- The five-year price graph and returns indicate unfavourable market conditions.

D. Final Investment Advice:

The company performance is just decent.

Market has jacked-up the price of the share unjustifiably.

PTL Enterprises share is not worth

investing at present. There are many companies available in the market right

now that have better performance and available at much attractive valuations.

Post Disclaimer: Opinions expressed here are the author’s personal opinions. Market conditions have a great bearing on many end results discussed in this report. No disrespect is intended towards the company, it’s management. Investors are advised not rely blindly on the opinions expressed herein but to exercise their own judgment. Neither the author nor the blog shall be responsible for any loss suffered by either acting or not acting based on the opinions expressed herein.

No comments:

Post a Comment