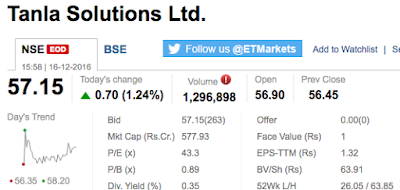

Tanla Solutions looks like a decent IT Enabled Services

company. But like Warren Buffett I too do not understand technology companies too

well. Please look at the market snapshot of Tanla share:

The price to earnings ratio of 43.3 is very high and the share

looks very expensive to buy. Price to Book Value Ratio of 0.89 looks

attractive. Dividend Yield of 0.35 is negligible and unacceptable. Market

capitalisation of Rs.577.93 crores is too small.

|

| Tanla Solutions Share's price movements graph of past five years |

The five year price graph shows price continuously climbing and does not bestow any special market advantage for buying.

|

| Tanla Solutions Share's returns or price increase in the last five years |

Five years return on the share of 852.50% shows steep appreciation, again not providing any special buying advantage.

The company started making profits only for the last two

years and for at lest three years preceding them the company incurred losses.

I have not investigated the company/ share thoroughly as

with this background I am not convinced about investing in the Tanla scrip and

I shall not recommend you invest too.

If you are keen in investing in an technology company why

don’t you consider Larsen and Tubro Infotech instead? You may:

- Read the investment research

report at: Larsen & Tubro Infotech Ltd. and

- Download in PDF format at: L&T Infotech.pdf

L&T Infotech has a strong brand value, good parentage

and is reasonably priced.

Good Research. Thanks for sharing information.

ReplyDeleteTanla Solutions Ltd

Tata Steel

long-term funds

LIC shareholdings