Dear Friend!

I had recently prepared and posted a brief

investment research report of Asian Paints on this blog.

I find that indeed Asian Paints is very good

company. However the market has made it undue preference and made it very, very

expensive to invest in.

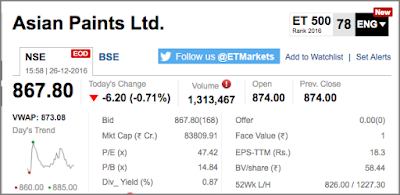

Have a look at the market snapshot of Asian

Paints share:

|

| Asian Paints' Share's Market Snapshot |

A PE multiple of 47.42 and a P2BV of 14.84?

How can one justify such high valuations, that too for a company that is

displaying decent but ordinary profitability margins?

The final conclusions and my investment advice

are as follows:

Final Conclusions:

- Asian Paints is without doubt a great company with market leadership and strong brand value. It will shine in any value investor’s portfolio.

- The EBDITA, EBT and PAT margins are decent but nothing to brag about. The company is consistently profitable for many years into the past.

- Current Ratio is a bit weak but TOL/ TNW and Long-term Debt-Equity Ratio are strong.

- Free cash flows are good and well deployed.

- PE Ratio of 47.42 makes the share highly expensive.

- Price to Book Value Ratio (P2BV) of 14.84 again makes the share very expensive and unaffordable.

- The market condition parameters of five-year price graph and five year returns do not favour buying the share presently.

- Though the company is distributing a good proportion of the profits as dividends, the high market price has pulled down the dividend yield.

Final Investment Advice:

- Asian Paints is a good company.

- Market price is too high.

- Only during post Lehman Brothers bank collapse like situations will the price come down. Even then it will never come down enough to bring down below a PE of 15 and P2BV of below 1.5. Buy the Shares of Asian Paints only during such times. Certainly not now.

Please read the full

investment research report:

- Read at: Asian Paints Investment Research Report

- Download a free pdf version at: Download Asian Paints Investment Research Report

Happy Investing!

Thank you,

With Best Regards

Anand

No comments:

Post a Comment