Ashok

Leyland Ltd.

Value

Investment Analysis Report

Basic Filtering Criteria:

|

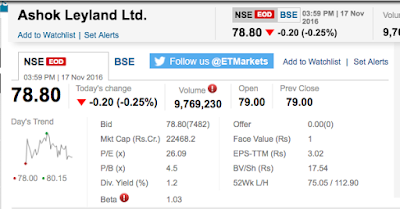

| Snapshot of Ashok Leyland Share's Market Conditions |

Critical prima-facie

Observations:

- PE Ratio: Ashok Leyland (AL)’s PE Ratio is 26.09 whereas the maximum acceptable number is 15 and the best for Indian conditions is 10.

- P2BV Ratio: Three times the recommended 1.50 times the book value at 4.5.

- Distance from 52 week low: On this parameter the scrip is in attractive zone – it is not very far away from the 52 week low – a mere 0.99% to be precise.

- Dividend Yield: Jus 1.2% compared to the recommended four - five percent and above.

- In light of the above, even though Ashok Leyland is one of the pioneering truck companies in the auto sector in India, along with Tata Motors, the scrip has to be rejected from including in the value investment portfolio at the current market conditions.

A. Company Performance

Profitability Analysis

Rs. in Crores [10 millions])

|

Mar ' 15

|

Mar ' 14

|

Mar ' 13

|

Mar ' 12

|

Mar ' 11

|

Income:

|

|||||

Operating income

|

18,821.58

|

13,562.18

|

9,943.43

|

12,481.20

|

12,841.99

|

Expenses:

|

|||||

Material consumed

|

13,338.21

|

10,026.35

|

7,652.84

|

9,197.12

|

9,532.93

|

Manufacturing expenses

|

115.96

|

82.49

|

61.04

|

86

|

76.75

|

Personnel expenses

|

1,398.75

|

1,184.00

|

999.67

|

1,075.51

|

1,020.39

|

Adminstrative expenses

|

1,802.69

|

1,242.70

|

1,063.31

|

1,246.10

|

955.83

|

Cost of sales

|

16,655.61

|

12,535.55

|

9,776.86

|

11,604.73

|

11,585.90

|

EBDITA

|

2,165.97

|

1,026.63

|

166.56

|

876.47

|

1,256.09

|

EBDITA % to Sales

|

11.51%

|

7.57%

|

1.68%

|

7.02%

|

9.78%

|

Depreciation

|

443.67

|

416.34

|

377.04

|

380.78

|

352.81

|

EBITA

|

1,722.30

|

610.29

|

-210.48

|

495.69

|

903.28

|

EBITA % to Sales

|

9.15%

|

4.50%

|

-2.12%

|

3.97%

|

7.03%

|

Financial expenses

|

273.54

|

393.51

|

452.92

|

376.89

|

255.25

|

EBT

|

1448.76

|

216.78

|

-663.40

|

118.80

|

648.03

|

EBT %

to Sales

|

7.70%

|

1.60%

|

-6.67%

|

0.95%

|

5.05%

|

Non-operating

income

|

109.87

|

124.47

|

66.52

|

62.35

|

40.35

|

PBT

|

1,558.63

|

341.26

|

-596.88

|

181.15

|

688.38

|

Tax charges

|

447.43

|

107.39

|

-120.6

|

37

|

124

|

PAT

|

1,111.20

|

233.87

|

-476.28

|

144.15

|

564.38

|

PAT as % to Sales

|

5.90%

|

1.72%

|

-4.79%

|

1.15%

|

4.39%

|

Non recurring items

|

-389.43

|

100.94

|

505.66

|

289.56

|

1.6

|

Reported net profit

|

721.78

|

334.81

|

29.38

|

433.71

|

565.98

|

Equity dividend

|

215.32

|

101.99

|

0

|

132.51

|

222.9

|

Dividend as % of Net Profits

|

29.83%

|

30.46%

|

0.00%

|

30.55%

|

39.38%

|

Dividend tax

|

55.04

|

26.07

|

-

|

27.13

|

43.16

|

Retained earnings

|

1,587.54

|

1,358.44

|

1,134.20

|

1,182.00

|

1,051.09

|

Remarks:

- EBDITA margins are only average. Only in the year 2015-16 the margin improved over low global commodity price and likely to revert to 7.5% band as commodity prices rise.

- The company has suffered loss in financial year 2012-13, demonstrating inconsistency in profitability.

- Market is giving a PE multiple of over 25 to AL whereas you can get many excellent companies posting 50% and above EBDITA margins still available at PE Multiples of below 10.

- Under the profitability parameter, low margins and loss in a financial year go against recommendation for inclusion.

Balance Sheet Analysis:

Balance Sheet:

|

|||||

Rs. in Crores [10 millions])

|

Mar ' 15

|

Mar ' 14

|

Mar ' 13

|

Mar ' 12

|

Mar ' 11

|

Sources of funds

|

|||||

Equity share capital

|

284.59

|

284.59

|

266.07

|

266.07

|

266.07

|

Reserves & surplus

|

4,207.74

|

3,812.30

|

3,007.89

|

4,189.04

|

2,628.75

|

Net Worth

|

4,492.33

|

4,096.89

|

3,273.96

|

4,455.11

|

2,894.82

|

Loan funds:

|

|||||

Secured loans

|

650

|

910

|

1,937.30

|

1,903.46

|

960

|

Unsecured loans

|

1,334.38

|

1,681.34

|

1,946.61

|

1,601.36

|

1,435.10

|

Current liabilities & provisions

|

5,887.01

|

5,601.46

|

4,476.20

|

5,136.77

|

5,312.47

|

Total Sources of Funds or Liabilities

|

16,856.04

|

16,386.57

|

14,908.03

|

17,551.81

|

13,497.21

|

Uses of funds

|

|||||

Fixed assets:

|

|||||

Net block

|

4,031.87

|

4,233.74

|

4,485.94

|

5,281.88

|

3,600.14

|

Capital work-in-progress

|

75.67

|

120.14

|

181.53

|

688.93

|

548.22

|

Investments

|

1,917.86

|

2,648.83

|

2,789.69

|

2,337.63

|

1,534.48

|

Current assets, loans & advances

|

6,338.31

|

5,286.96

|

4,176.92

|

4,788.26

|

4,919.55

|

Intangible Assets

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

Total Uses of Funds or Assets

|

6,476.70

|

6,688.22

|

7,157.87

|

7,959.93

|

5,289.92

|

Current Ratio

|

1.08

|

0.94

|

0.93

|

0.93

|

0.93

|

Total Outside Liabilities

|

12,363.71

|

12,289.68

|

11,634.07

|

13,096.70

|

10,602.39

|

Tangible Net Worth

|

4,492.33

|

4,096.89

|

3,273.96

|

4,455.11

|

2,894.82

|

TOL/ TNW

|

2.75

|

3.00

|

3.55

|

2.94

|

3.66

|

Highlights:

- The current ratio of 1.08 in 2016 and below 1 in prior years, as against the recommended two, is extremely and unacceptably poor. If not for Brand Reliance any other ordinary company having such poor ratios would find it difficult to raise working capital loans from commercial banks in India.

- The TOL/ TNW even though below the recommended 3 in the recent financial year is not very impressive.

- Finally on the balance sheet front current ratio below 2 and average TOL/ TNW Ratio recommend dropping the scrip from a value investor’s portfolio for the present.

Dividends

Distribution

of net Profits

Let

us study the dividend distribution pattern of Ashok Leyland

Rs. in Crores [10 millions])

|

Mar ' 15

|

Mar ' 14

|

Mar ' 13

|

Mar ' 12

|

Mar ' 11

|

PAT

|

1,111.20

|

233.87

|

-476.28

|

144.15

|

564.38

|

PAT as % to Sales

|

5.90%

|

1.72%

|

-4.79%

|

1.15%

|

4.39%

|

Non recurring items

|

-389.43

|

100.94

|

505.66

|

289.56

|

1.6

|

Reported net profit

|

721.78

|

334.81

|

29.38

|

433.71

|

565.98

|

Equity dividend

|

215.32

|

101.99

|

0

|

132.51

|

222.9

|

Dividend as % of Net Profits

|

29.83%

|

30.46%

|

0.00%

|

30.55%

|

39.38%

|

The above table shows that the company

has been generously distributing about 30-40% of the net profits as dividends.

Uninterrupted

Dividend Payment History

Announcement Date

|

Effective Date

|

Dividend Type

|

Dividend(%)

|

25/05/2016

|

13/07/2016

|

Final

|

95%

|

12/05/2015

|

17/06/2015

|

Final

|

45%

|

10/05/2013

|

04/07/2013

|

Final

|

60%

|

14/05/2012

|

12/07/2012

|

Final

|

100%

|

19/05/2011

|

29/06/2011

|

Final

|

200%

|

29/04/2010

|

16/07/2010

|

Final

|

150%

|

15/05/2009

|

14/07/2009

|

Final

|

100%

|

08/05/2008

|

16/07/2008

|

Final

|

150%

|

14/03/2007

|

28/03/2007

|

Interim

|

150%

|

03/05/2006

|

12/07/2006

|

Final

|

120%

|

28/04/2005

|

07/07/2005

|

Final

|

100%

|

11/06/2004

|

29/06/2004

|

Final

|

75%

|

02/05/2003

|

30/06/2003

|

Final

|

50%

|

07/05/2002

|

04/07/2002

|

Final

|

45%

|

24/04/2001

|

18/06/2001

|

Final

|

40%

|

22/04/2000

|

Final

|

35%

|

|

21/07/1999

|

Final

|

10%

|

|

30/06/1998

|

Final

|

10%

|

|

20/06/1997

|

Final

|

50%

|

- The company has maintained an uninterrupted dividend paying track record for the past 19 years.

- Even in the financial year 2012-13, when the company made loss, it has paid dividends not from the current year profits but out of accumulated profits.

- On the dividends front AL has shown impeccable credentials.

B. Market Conditions

Five-year price graph:

|

| Price Graph of Ashok Leyland Share for the last five years |

The

graph above shows that the stock price having remained muted for about two

years between 2012–2014, and suddenly springs-up to life and steeply climbs

from Rs.18 level to over Rs.75 apiece.

Five years price rise (returns) table:

|

| Picture depicts table of five year price increase percentage s of Ashok Leyland scrip |

Besides

the price graph, the five years return

is 207.81% and in the last three years 421.85%. This means that Ashok Leyland’s

share price had gone up four times in the last the years.

This

is an unfavourable market condition which indicates that having already

appreciated four times, the scope further steep price gain for the investor

today is very difficult.

C. Conclusion and Final Investment Comment:

- Ashok Leyland is without doubt a wonderful company and brand.

- The truck business in the auto sector is very challenging.

- Sales are linked with the country’s economic growth

- Competition from new aggressive multinational entrants in the past two decades

- The company’s performance is average in the challenging environment.

- The market conditions, especially the steep increase in share price in the last three years, has taken the price to earnings (PE) and price to book (P2BV) ratio out of a value investor’s acceptable levels.

- The price is not recommended for inclusion under the present market conditions.

- Even when market conditions vastly improve and bring down the PE and P2BV ratios, the company’s performance in the present ratios will only suggest inclusion as a means of diversification rather than as an attraction.

D. Important Notice:

Kindly note that this is a very superficial

analysis of the company for the results of such a preliminary study do not

justify any further investment of time for in-depth analysis

Thanks for sharing valuable information.

ReplyDeleteTCOM

debt

EBITDA

Share Market