What is Income Investing?

Income Investing is investing for a regular income in the forms of dividend on stocks and shares or interest on corporate bonds, fixed deposits, savings accounts and so on. The income may not be fixed income per se, it may be variable, but it surely should be regular. Such an investing approach is called income investing and such investors are called income investors.

The flock of income investors, invariably a part of value investors, is fairly large. It certainly includes me. Income Investors like copious and regular income in the form of dividends and fixed income by way of interest, besides mere capital appreciation or increase in the market value of the investments. Therefore income investors seriously check the dividend history of the companies they propose to invest in. Such an approach is well justified. For example, a worker needs a monthly wage to sustain herself and her family - she cannot be merely content with just retirement benefits however attractive they might be, can she? Dividends and income from interest from investments constitute the wages of investors.

In this article, we will focus more on the dividend aspect of income investing as fixed income in the form of interest income on corporate bonds and fixed deposits is inescapable and their quantum is predetermined, unlike equity dividend where the company management has the discretion to pay or not pay determine the quantum of dividend as per the dividend policy.

Dividend Policy

Company managements decide when and what quantum of dividends to pay to shareholders through the dividend policy.

Company managements fall under two opposite categories - those who believe in rewarding shareholders with a handsome dividend and those who pay a very small or absolutely no dividend, reinvest the profits for growth. The growth represents general growth of the business, revenues, profits and finally and consequently growth in the earnings per share (eps). Their logic is that as the EPS grows, the market price of the share will increase and the investors are rewarded by such price increase instead of through dividends.

Dividend History

Besides the dividend policy, the dividend history is equally important. There are two aspects to dividend history:

- Dividend history relating to the total number of years for which dividends were paid by the company out of the total number of years of its existence.

- Dividend history of uninterrupted dividend payments.

For example, let us consider the dividend histories of two companies as follows:

Flamboyant Ltd.

|

Conservative Ltd.

|

|

Number of years of existence

|

27

|

27

|

Number of years for which dividends paid

|

20

|

20

|

Number of breaks in paying dividend

|

5

|

0

|

Dividend History of number of years of uninterrupted dividend payment

|

8

|

20

|

In the above example "Messers Conservative Ltd." is certainly more investible company than "Messers Flamboyant Ltd.", even though both companies have the same number of years of dividend paying history.

Why?

Because Messers Conservative Ltd. has the longest uninterrupted dividend paying record and has no break. Whereas Messers Flamboyant Ltd. only has eight years of uninterrupted dividend paying history and has stopped paying dividends five times in the total period of 27 years of existence and 20 years of dividend paying track record.

Why should we Opt for Income Investing?

Investors Deserve a wage

Investing, especially value investing is like farming and involves plenty of labour, patience and character. Therefore an investor is entitled to a wage for her labour, besides just capital appreciation, and income from investments exactly constitutes that compensation. Therefore income investors must certainly and carefully study the uninterrupted dividend history of the company before making the investment decision.

Capital Erosion

There is another equally important reason why receiving regular and bounteous dividends is more beneficial for the investor than being rewarded through growth in EPS and share price increase. This reason is the potential capital erosion.

It is not uncommon to see that companies and managements that pursued growth at the cost of rewarding shareholders by way of dividends, suddenly being overtaken by catastrophic events like technological changes, corrosion of the sustainability of their business model, leading to the erosion of the share price and investor's capital erosion.

Let us take a real example.

Bharati Airtel Ltd. is a top telecommunications company and brand in India. Idea Cellular and Vodafone are two other dominant players in the market. Airtel had been making handsome profits but been stingy in paying dividends, perhaps in pursuit of growth. On 5th September 2016 Reliance Industries Ltd., a huge industrial conglomerate entered the telecommunications scene with its brand Jio along with game changing, free or ridiculously low priced offers. All the hitherto major players were caught unawares. Customers are leaving them in droves. Airtel and all other players' customer base is shrinking rapidly and their profit margins have evaporated overnight. To compound their woes, these players had borrowed heavily from banks in the past to acquire spectrum. They are staring at a stark future.

Let us look at the graph data table depicting Airtel's net profit margin and its dividend payout ratio (the proportion net profits distributed as dividends) below:

We can observe that the standalone net profit margin of Airtel has suddenly plunged from about 15 to 25% of sales to a net loss of nearly 16% for the financial year ending 31st March 2017. The dividend payout ratio was never over 12% of net profits (central public sector companies are expected to pay a minimum of 30% of net profits as dividends).

What is the fate of Airtel's shareholders?

An investor who had bought the share on 13th May 2009 eight years ago at Rs.450.34 earned a paltry sum of Rs.11.77 as dividend during the entire eight-year period, a return on investment of 2.61% in eight years or 0.33% per annum. At the end of the eight years, her original investment had eroded by Rs.41.93 (capital loss on investment). After adjusting the return on investment of Rs.11.77, the net capital loss ends up at Rs.30.16 a share. If she does not exit her investment soon, under the business conditions confronting Airtel most likely her investment will be completely wiped off.

However had Airtel been generous in distributing its profits by way of dividends and assuming it had paid 40% of its net profits as dividends, the investor could have exited the investment with no capital loss and with a marginal profit as shown in the following table:

Based on Airtel' Actual Paid Dividends

|

Had Airtel Distributed 40% of its Net Profits as Dividends

|

|

Original Investment

|

450.34

|

450.34

|

Exit Value

|

408.41

|

408.41

|

Gross Capital Loss on the Investment

|

41.93

|

41.93

|

Recovery of investment by way of Dividend

|

11.77

|

66.35

|

Net Capital Profit/ Loss

|

-30.16

|

24.42

|

I hope now it becomes clear why investors must invest in the shares of those companies whose managements reward the shareholder generously through dividends.

For Who Income Investing Is Recommended?

If the income investing relates to interest income from corporate bonds and fixed deposits it is recommended who are presently in the possession of a very large corpus to invest and are looking for earning a regular income. For example, a person who inherited a huge wealth or a university which has a large corpus contributed by its alumni.

On the other hand for the majority of us who have to create a wealth out of our own efforts stock dividend based income investing is only suitable. Corporate bonds and other regular income yielding investments like debt mutual funds are not suitable and hence not recommended.

Dividend based income investing is, of course, suitable for all including the one who has a large investible corpus up front.

When is the Right Time to Start Income Investing?

Income investing can be started anytime. All times are suitable. The beauty of the financial markets is that an investor will always be able to find attractive investment opportunities.

In the case of stocks, once we have thoroughly researched and collected a good portfolio of stocks, we will always find a few of them available at reasonable prices irrespective of whether the stock market is at a peak. If the stock market is at a low or at the bottom, of course, we will find plenty of attractive investment opportunities.

In essence, every time is a good time to begin income investing and thankfully one need not wait for a good time to begin or attempt timing the market.

Where to Find the Stocks Suitable for Income Investing?

Luckily high dividend yield stocks are available in good numbers and always. You can find top ten high dividend paying stocks by clicking here.

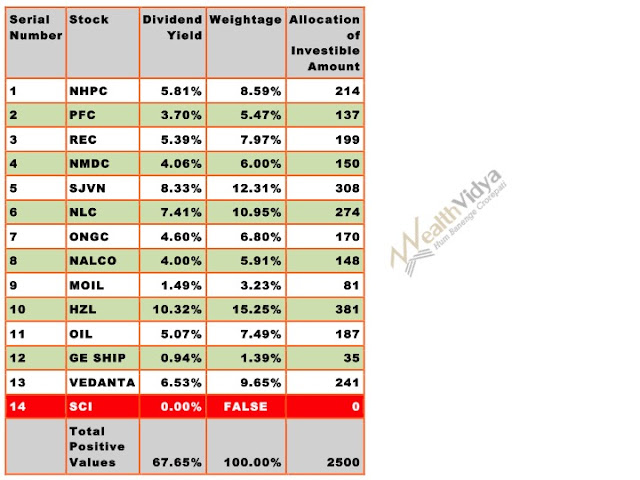

Further every month I post a list of stocks that are suitable for investing for the month on various criteria including dividend yield. For example, you can see the list for August 2017 here.

How to Find the Stocks Suitable for Income Investing?

We cannot invest in equity shares of companies purely based on dividend yield. The dividend is not the sole factor influencing the investment decision but only one of the many stringent tests to which the stocks need to be subjected to. The procedure of identifying the stocks in which investments can be made is not so simple and straightforward that it can be explained in a single article or blog post. Therefore I will briefly describe the steps to be followed and guide you to other articles that explain the process in details.

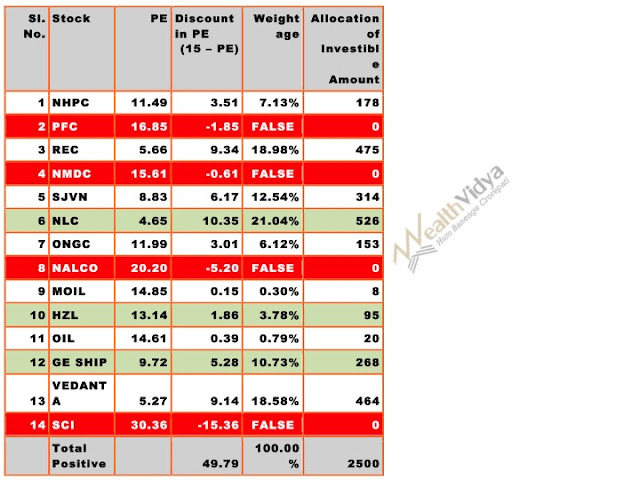

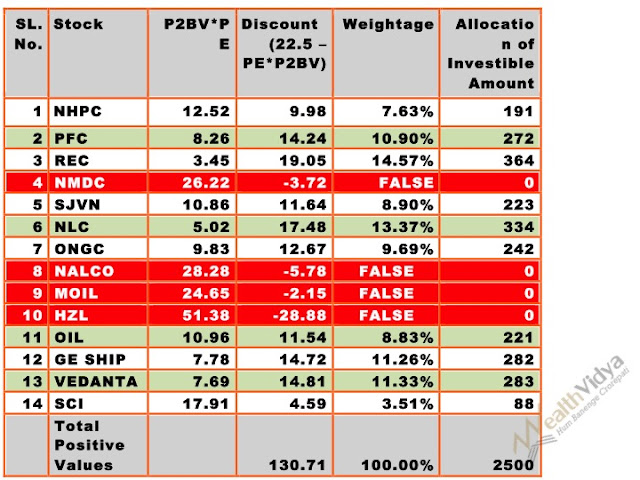

- Use one of the many stock filters/ stock screeners. Here is one of them I use. It is Kotak Stock Filter. In this stock filter use only the P/E Ratio Criterion. Specify the number between 0.01 to 15. This will throw up a handful of stocks for further investigation.

- The shortlisted stocks need to be subjected to a thorough investigation based on criteria like company performance, market conditions. Please see the analysis of The Great Eastern Shipping Company Limited.

- Besides the company's past performance it's ability to perform for a long time in the future is also vitally important. In order to do so, the company should possess a sustainable business model.

What to Do with Income Generated from Investments?

Finally, the fixed income of interest and dividend income from shares, generated from the prudent investments, shall not be spent or consumed but re-invested to generate further passive incomes. Only actively earned income can be utilised for consumption spending. Reinvestment is the only path to financial freedom and wealth creation.

Suggested Further Reading:

- How to Find the Fair Price of A Stock?

- Margin of Safety

- Where to Find Industry Wise Price to Earnings Ratios for Indian Stocks?

- How to Calculate the Intrinsic Value of Shares?

- Buy Wonderful Stocks at Fair Price

- It is Far Better to Buy A Wonderful Company at a Fair Price than a Fair Company at Wonderful Price

- You Only Find Out Who is Swimming Naked When The Tide Goes Out

- Everything You should know about Dividends before you Invest

- How to Achieve Financial Freedom?

Conclusion

Regular income from the investments is important for investors. While income from interest on corporate bonds and deposits is automatic and mandatory, when it comes to dividends there is an element of uncertainty. Some company managements are very miserly in paying dividends to investors, ostensibly in pursuit of growth. However more often they end up doing great injustice to the shareholders by their dividend policy. Investors are well advised to shun the stocks of such companies, for, after all, dividends are the wages of investors and they are rightfully entitled to their wage.