NMDC Ltd., earlier styled National Mineral Development Corporation Ltd., is a public sector company. It is a Navaratna company (one of the nine gems - a recognition given to the nine best performing public sector companies).

The company is mainly engaged in extracting and exporting iron ore, a commodities business, nothin spectacular.

It is one of the main components of our value investing portfolio.

Let us examine its financial fundamentals.

|

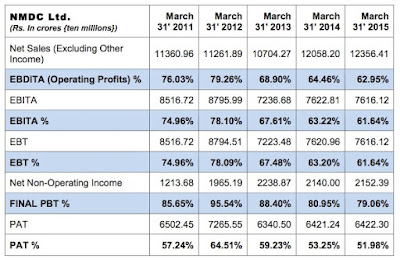

| Table showing NMDC Limited's Profitability Ratios |

Besides enviable EBDITA and PAT margins, it has significant non operating incomes. Non operating income constitutes nearly one third of its operating income. It also constitutes 63 to 110% of the dividends paid in the last five years, which means even if there are no operating incomes, the company will be able to maintain the present dividends, which in themselves are very high compared to the other companies, at over 50% of the net profits in the last three years.

|

| Table shows NMDC's dividend coverage by non-operating income |

We have got dividend at 11.11% on our investment tax free, which translates into a whopping 16.58% return on our investment. What else one wants? What

After all these excellent advantages, the scrip is available at a price to earnings (PE) ratio below 10 and price to book value (P2BV) ratio of 1.18, both the parameters meeting the crucial value investing principles.

No wonder we call NMDC Ltd., a goose that lays golden eggs, year after year.

One financial analyst of a leading Indian financial newspaper dismissed the case of NMDC as just that of purely a dividend play, suggesting rather degradingly that the scrip offers no value other than good dividends. What naivety! Today every Tom, Dick and Harry, who dabbles in shares a bit or who has been employed in a mutual fund has become an investment expert and passes such ridiculous comment