Like Warren Buffett, Walter Schloss too had been taught by Bnjamain Graham in the discipline of value investing. Practicing Graham's teaching Schloss too achived great investing success.

|

| Legendary Value Investor Walter Schloss |

Apparently Schloss did not possess formal college degree and had been employed as a runner on the Wall Street in 1934 at the age of 18, and had taken Graham's investment classes at the New York Stock Exchange.

His focus was on book value of stocks rather than on earnings. See what he says in his own words, "Try to buy assets at a discount than to buy earnings. Earning can change dramatically in a short time. Usually assets change slowly. One has to know much more about a company if one buys earnings."

He joined Graham at 'Graham-Newman Partnership'. In 1955 he left the firm and started his own investment firm, managing the investments of 92 investors.

Schloss achieved a compounded average growth rate (CAGR) of 15.30% for a whopping four and a half decades - maintaining a CAGR over such a long period of time is a Herculean task - as against the S&P 500's 10% for the same period.

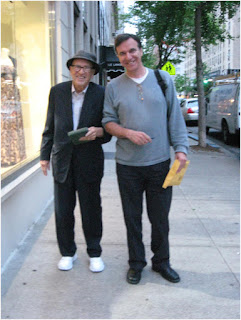

|

| Walter Scholl on a Stroll. Source: Bem Graham Institute for Value Investing |

Schloss' Teaching:

The 16 golden

rules for investing propounded by Walter Scholoss, gleaned from a 1994 lecture

he gave:

1. Price is the most important factor to use in relation to value

2. Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper.

3. Use book value as a starting point to try and establish the value of the enterprise. Be sure that debt does not equal 100% of the equity. (Capital and surplus for the common stock).

4. Have patience. Stocks don’t go up immediately.

5. Don’t buy on tips or for a quick move. Let the professionals do that, if they can. Don’t sell on bad news.

6. Don’t be afraid to be a loner but be sure that you are correct in your judgment. You can’t be 100% certain but try to look for the weaknesses in your thinking. Buy on a scale down and sell on a scale up.

7. Have the courage of your convictions once you have made a decision.

8. Have a philosophy of investment and try to follow it. The above is a way that I’ve found successful.

9. Don’t be in too much of a hurry to see. If the stock reaches a price that you think is a fair one, then you can sell but often because a stock goes up say 50%, people say sell it and button up your profit. Before selling try to reevaluate the company again and see where the stock sells in relation to its book value. Be aware of the level of the stock market. Are yields low and P-E rations high. If the stock market historically high. Are people very optimistic etc?

10. When buying a stock, I find it heldful to buy near the low of the past few years. A stock may go as high as 125 and then decline to 60 and you think it attractive. 3 yeas before the stock sold at 20 which shows that there is some vulnerability in it.

11. Try to buy assets at a discount than to buy earnings. Earning can change dramatically in a short time. Usually assets change slowly. One has to know much more about a company if one buys earnings.

12. Listen to suggestions from people you respect. This doesn’t mean you have to accept them. Remember it’s your money and generally it is harder to keep money than to make it. Once you lose a lot of money, it is hard to make it back.

13. Try not to let your emotions affect your judgment. Fear and greed are probably the worst emotions to have inconnection with purchase and sale of stocks.

14. Remember the work compounding. For example, if you can make 12% a year and reinvest the money back, you will double your money in 6 yrs, taxes excluded. Remember the rule of 72. Your rate of return into 72 will tell you the number of years to double your money.

15. Prefer stock over bonds. Bonds will limit your gains and inflation will reduce your purchasing power.

16. Be careful of leverage. It can go against you.

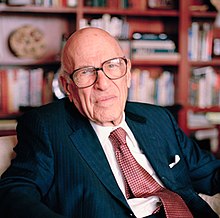

| Walter J. Schloss Source: Wikipedia | |

|---|---|

| |

| Born | August 28, 1916 New York City, U.S. |

| Died | February 19, 2012 (aged 95) New York City, U.S. |

| Nationality | United States |

| Education | No formal college education |

| Occupation | Investor |

| Employer | Graham-Newman Partnership |

| Known for | Manager of Walter & Edwin Schloss Associates |