Dear Friend!

Rural Electrification

Corporation (REC) Ltd. is a wonderful company.

I too own 564 shares as

on date at an average holding cost of Rs.125.07.

Last week, while I was

on vacation in Goa, I received two sms alerts informing me that the scrip has

corrected by 5.58 and 5.08%, respectively.

Many people might have

been spooked by such alerts, but not value investors. I did not panic at all,

for I kew very well that REC is a wonderful company and nothing could go

fundamentally wrong with it so suddenly.

After returning from the

holiday I investigated the cause for the steep and sudden fall.

I was relieved to fund

out that the cause for the market panic was a fairly large provision for

contingency of Rs.616.19 crores (most likely towards bad debts) and

consequent dip in the quarterly profit after tax to the extent of 24.80%

compared to the previous quarter.

Tighter regulations and

close monitoring of ‘Non

Performing Assets (NPAs)’ from the last couple of years is forcing all

financial institutions to come clean on their NPAs. Banks especially public

sector banks have been making huge provisions for many quarters in the past.

REC and PFC also have been making such provisions, though to a lesser extent.

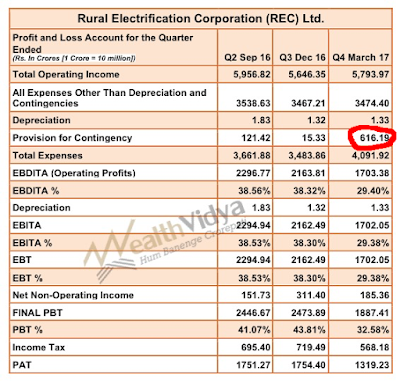

Please see the following

table for the provisions made in the last three quarters:

You can see for yourself

that though fairly large, this provision is certainly not alarming, nor is the

dip in the profits. REC continues to maintain very strong PBT and PAT margins

of over 32% and 22% respectively.

In conclusion let me

reiterate that the fundamentals of REC are intact, that there is no need to

panic, please do hold the shares you already have and continue to buy as the

scrip is available at discounted prices with a price

to earnings (PE) ratio of 6.02 and a price

to book value ratio of 0.65.

Thank you,

With Best Regards,

Anand