Rashtriya

Chemicals and Fertilisers Ltd.

Company history and business:

Rashtriya

Chemicals & Fertilizers Ltd. (RCF), incorporated in the year 1978, is a Mid

Cap company (having a market cap of 3213.58 Cr.) operating in Fertilisers sector.

Rashtriya Chemicals and Fertilizers Limited (RCF)

a Government of India Undertaking is a leading fertilizer and chemical

manufacturing company with about 80% of its equity held by the Government of

India. It has two operating units, one at Trombay in Mumbai and the other at

Thal, Raigad district, about 100 KM from Mumbai. Government of India has

accorded "Mini-Ratna" status to RCF.

RCF is one of the earliest units set up in the

country for fertilizer production. It manufactures Urea, Complex Fertilizers,

Bio-fertilizers, Micro-nutrients, 100 per cent water soluble fertilizers, soil

conditioners and a wide range of Industrial Chemicals. It produces 23 lac MT

Urea, 6.5 lac MT Complex fertilizers and 1.6 lac MT of Industrial Chemicals

every year. The company is a household name in rural India with brands

"Ujjwala" (urea) and "Suphala" (complex fertilizers) which

carry a high brand equity. RCF has countrywide marketing network in all major

states. Apart from the own manufactured products, the Company is also engaged

in marketing of SSP and imported fertilizer inputs like, DAP, MOP & NPK

fertilizers. Besides fertilizer products, RCF also produces almost twenty

industrial chemicals that are important for the manufacture of dyes, solvents,

leather, pharmaceuticals and a host of other industrial products.

RCF’s key

Products/Revenue Segments include Subsidy which contributed 4574.00 Cr to Sales Value (52.02 % of Total

Sales), Neem Coated Urea which contributed 1276.47 Cr to Sales Value (14.51 % of Total

Sales), Suphala 15:15:15 which contributed 1041.35 Cr to Sales Value (11.84 %

of Total Sales), other products contributed the balance.

|

| RCF's bag of fertilizer, "Saphala |

Basic Filtering Criteria:

|

| Rashtriya Chemicals & Fertilisers Ltd Share's market Snapshot |

(Rs. Crore/ Rs. 10 million)

|

Minimum Required

|

Actual

|

||

1

|

Turnover

|

1000

|

8,649

|

Pass

|

2

|

Market Capitalization

|

1000

|

3213

|

Pass

|

3

|

Price to Earnings Ratio

|

Less than 15

|

20.25

|

Fail

|

4

|

Price to Book Value

|

Less than 1.5

|

1.09

|

Pass

|

5

|

Dividend Yield

|

4-5%

|

1.96%

|

Fail

|

As per basic value investing filtering

criteria Rashtriya Chemicals’s share can be taken up as it passes three out of

the five filtering criteria.

|

| Rashtriya Chemicals & Fertilisers Ltd's Factory Panoramic View |

A. Company Performance

Profitability

Analysis

Rashtriya Chemicals & Fertilizers Ltd.

Profit & Loss Account (Rs. Crore/ Rs. 10 million)

|

Mar ' 16

|

Mar ' 15

|

Mar ' 14

|

Income:

|

|||

Operating income

|

8,649.43

|

7,713.45

|

6,587.60

|

Expenses:

|

|||

Material consumed

|

4,185.71

|

3,691.05

|

3,289.44

|

Manufacturing expenses

|

2,380.21

|

1,576.37

|

1,318.92

|

Personnel expenses

|

492.44

|

526.24

|

442

|

Adminstrative expenses

|

1,124.73

|

1,109.45

|

970.92

|

Cost of sales

|

8,183.09

|

6,903.11

|

6,021.28

|

Operating profit (EBDITA)

|

466.34

|

810.34

|

566.32

|

Financial expenses

|

142.32

|

116.95

|

131.29

|

Depreciation

|

145.13

|

258.12

|

141.75

|

Other income

|

112.21

|

74.36

|

74.04

|

PBT

|

291.1

|

509.63

|

367.32

|

Tax charges

|

99.87

|

187.57

|

117.43

|

PAT

|

191.23

|

322.06

|

249.89

|

EBDITA % to Sales

|

5.39%

|

10.51%

|

8.60%

|

EBT % to Sales

|

2.07%

|

5.64%

|

4.45%

|

Interest Cost as %

of Sales

|

1.65%

|

1.52%

|

1.99%

|

PBT % to Sales

|

3.37%

|

6.61%

|

5.58%

|

PAT % to Sales

|

2.21%

|

4.18%

|

3.79%

|

Highlights:

- Over 50% of sales revenues comprise of subsidy from government, making the companies profitability and cash flows dependent and vulnerable.

- P&L Account reveals very low profitability margins though there are no losses.

- Interest cost constitutes a significant proportion of already weak profitability margin.

On

profitability parameter the company’s performance appears poor.

Balance Sheet Analysis

Rashtriya Chemicals Ltd.

Balance Sheet (Rs. Crore/ Rs. 10 million)

|

Mar '

16

|

Mar '

15

|

Mar '

14

|

Sources

of funds

|

|||

Equity share capital

|

551.69

|

551.69

|

551.69

|

Reserves & surplus

|

2277.43

|

2159.24

|

1956.70

|

Net Worth ( C )

|

2829.12

|

2710.93

|

2508.39

|

Secured loans

|

1289.61

|

964.82

|

1128.68

|

Unsecured loans

|

1466.43

|

919.63

|

538.41

|

Total Loan Funds (A)

|

2756.04

|

1884.45

|

1667.09

|

Current liabilities & provisions (B)

|

2100.86

|

1644.42

|

1439.37

|

Total Liabilities

|

7686.02

|

6239.80

|

5614.85

|

Uses of

funds

|

|||

Fixed assets

|

|||

Net block

|

1496.56

|

1501.04

|

1619.67

|

Capital work-in-progress

|

149.97

|

61.16

|

77.19

|

Total Fixed Assets

|

1646.53

|

1562.20

|

1696.86

|

Investments

|

0.19

|

0.17

|

17.86

|

Current assets, loans & advances

|

6039.30

|

4677.43

|

3900.13

|

Miscellaneous expenses not written off (D)

|

0.00

|

0.00

|

0.00

|

Total Assets

|

7686.02

|

6239.80

|

5614.85

|

Total Outside Liabilities (TOL) = A+B

|

4856.90

|

3528.87

|

3106.46

|

Tangible Net Woth (TNW) (C-D)

|

2829.12

|

2710.93

|

2508.39

|

Current Ratio

|

2.87

|

2.84

|

2.71

|

Long Term Debt Equity Ratio

|

0.97

|

0.70

|

0.66

|

Total Outside Liabilities/ Tangible Net Worth TOL/ TNW

|

1.72

|

1.30

|

1.24

|

Highlights:

- Current Ratio is strong at 2.87 but only a marginal improvement over last year, indicating low profits unable to improve liquidity significantly.

- Debt equity ratio declined from 0.66 in FY 2013-14 to 0.97 in FY 2015-16.

- TOL/ TNW Ratio too has deteriorated from 1.24 to.

Overall, the Balance Sheet of Rashtriya

Chemicals though strong is depicting deterioration.

|

| Fortified entrance to one of RCF's Facilities |

Cash Flow Analysis:

Cash Flow Statement (Rs. Crore/ Rs. 10 million)

|

Mar '

16

|

Mar '

15

|

Mar '

14

|

Mar '

13

|

Mar '

12

|

Profit before tax

|

291.1

|

509.63

|

367.32

|

380.12

|

374.46

|

Net cash flow-operating activity

|

-635.65

|

228.05

|

313.73

|

-587.68

|

-155.53

|

Net cash used in investing activity

|

-260.14

|

-216.41

|

-81.88

|

229.07

|

-786.94

|

Net cash used in fin. activity

|

813.92

|

2.87

|

-208.25

|

307.07

|

620.5

|

Net inc/dec in cash and equivalent

|

-81.87

|

14.51

|

23.6

|

-51.54

|

-321.97

|

Cash and equivalent begin of year

|

83.23

|

68.72

|

45.63

|

97.17

|

419.14

|

Cash and equivalent end of year

|

1.36

|

83.23

|

69.23

|

45.63

|

97.17

|

Highlights:

- Net Cash Flow from operating activities or free cash flow, which is the backbone of the company’s health are negative (in the red ) in three out of five years.

- Positive figures in Net Cash used in financing activity indicate borrowings. In those three years of negative operating cash flows the company resorted to heavy borrowing.

Overall RCF’s cash flows show

fundamental structural weakness.

Dividend Track Record

Year

|

Dividend (%) of

Face Value of Shares

|

2016

|

11

|

2015

|

18

|

2014

|

15

|

2013

|

15

|

2012

|

14

|

2011

|

11

|

2010

|

11

|

2009

|

12

|

2008

|

10

|

2007

|

10

|

2006

|

10

|

2005

|

17

|

2004

|

17

|

2002

|

2

|

2001

|

4

|

2000

|

2

|

1999

|

6

|

1998

|

5

|

1997

|

2

|

Highlights:

Company’s

uninterrupted dividend paying track record is very strong. At least for 19 long

years the company has paid dividends without break!

On

this parameter the company’s performance is Excellent.

Dividend Pay-out Ratio

Mar '

16

|

Mar '

15

|

Mar '

14

|

Mar '

13

|

Mar '

12

|

|

Profit After Tax (PAT)

|

191.23

|

322.06

|

249.89

|

280.9

|

249.24

|

Equity dividend

|

48.34

|

79.08

|

68.71

|

68.69

|

64.71

|

Dividend tax

|

12.35

|

20.22

|

14.04

|

14.06

|

12.53

|

Total

Dividend Pay-out

|

60.69

|

99.3

|

82.75

|

82.75

|

77.24

|

Dividend

Pay-out Ratio

|

31.74%

|

30.83%

|

33.11%

|

29.46%

|

30.99%

|

Highlights:

- It is quite evident from the above that the company is distributing a good portion of its profits as dividends.

- Unfortunately in an effort to maintain this reputation and in the face of negative operating cash flows, the company is borrowing heavily – in short dividends are paid from borrowed money. This is certainly not good for either the company or the investors in the long run.

On this parameter the company’s track

record is excellent, but harmful for the company and its investors.

B. Market Conditions:

Price to Earnings Ratio:

A PE Ratio of

20.25 is not favorable.

Market

condition on this parameter is not favorable.

Price to Book Value per Share: With a price to book value ratio at 1.09

the market condition is below the maximum permitted 1.5 and therefore is

favorable. Of course the assets are not available on a discount – they are just

available at their full value with a slight premium attached.

Market

condition on this parameter is favorable.

Dividend Yield:

Dividend yield

of 1.96 is poor. The low dividend is caused by low profits. Company has to be

praised for shelling out over 30% of profits towards dividends.

Market

condition on this parameter is unfavorable, but the company can be forgiven.

Distance from 52 week high: The share price is far away from the 52

week low and very near the 52 week high.

Five-year price graph:

|

| Five years price graph of RCF Ltd.'s Share |

The price graph

clearly shows that after falling steeply for about two and a half years from

middle of 2012 again the price climbed steeply from middle 2014, seesawing

thereafter.

Therefore

current market condition is not very favourable.

Five-year share price return:

|

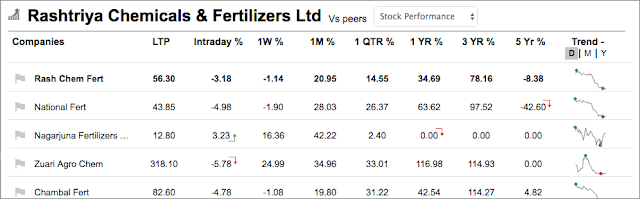

| Rashtriya Chemicals Share Five Year Returns |

Table shows that even though the share

price of RCF has appreciated over 34% in the last one year, 78% in the last

three years and about 8% lower than what it was five years ago – which means

that you are able to buy the share below what was prevailing five years back.

But we must understand that the EPS of RCF’s share was 23% more at Rs.4.52

compared to the FY-2015-16’s Rs.3.47.

On

this parameter the market condition is not favourable.

C. Final Conclusions:

- Rashtriya Chemicals Ltd. is a good company but operates in a wrong sector - agriculture. Receiving government subsidy and erratic weather are two adverse environmental factors inherent to the business model.

- Profits are low.

- Operating cash flows have been negative in three out of five years in the past. Company is borrowing to bridge the gap, further eroding profitability margins.

- Balance sheet ratios though is strong zone are declining continuously.

- Market conditions are not very favourable either.

D. Final Investment Advice:

Avoid

investing in this company.

Post Disclaimer: Opinions expressed here are the author’s personal opinions. Market conditions have a great bearing on many end results discussed in this report. No disrespect is intended towards the company, it’s management. Investors are advised not rely blindly on the opinions expressed herein but to exercise their own judgment. Neither the author nor the blog shall be responsible for any loss suffered by either acting or not acting based on the opinions expressed herein.