Capital

is the money invested by the owner(s) of the business to meet the requirements

of the business.

In

the case of proprietary concerns it is called ‘proprietor’s capital’ and if it were a partnership firm it is

called ‘partners’ capital’.

Share and Share Capital

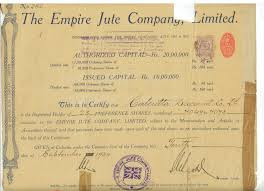

During the colonial period businessmen found that it required a lot more capital to organise trade venture to far-off countries. Besides huge financial requirements, the ventures were fraught with a risk that is impossible for one or few individuals to bear. This resulted in the creation of joint stock companies, where the huge capital requirement is split into thousands of small units called shares, so that these small units can be easily sold to many hundreds and thousands of investors. The capital raised by the sale of ‘shares’ is called the ‘share capital’.Limited Liability

Considering the large risks involved in the voyages/ ventures, by law the risk also was limited only to the amount invested, leaving the investors’ personal properties safe and untouched in the event the venture/ company failed. This was not and even today is not the case with proprietary concerns and partnership firms. The word 'Limited', 'Ltd.' in the short form are derived from and denote the limited or restricted liability of the shareholders or owners in the case of a joint stock company.The East India Company is good example of a joint stock company.

Later

evolution and sophistication resulted into two popular types of share capital, equity and preference (also called preferred).

In conclusion, capital is owner(s) investment in the business. In the case of a company it is called share capital. It is a liability owed to the owners. It is the last item to be repaid in the event of liquidation of a business.

In a nutshell, preference shares enjoy priority in terms of

payment dividends as well as repayment of principal over equity shares.

Equity shares though least in priority and more risky

nevertheless are bestowed with a feature of participation in the surplus.

Equity shares are crafted based on the principle rewards is proportionate to

risks.

Capital is a Liability of the Business

In

the modern commercial world, the owner(s) of the enterprise and the business

are treated as separate entities. Therefore the business treats the money invested by the owners/ shareholders as money it owes to the owners. shareholders and therefore in the account books of the business the capital is shown as a liability. In the balance sheet, capital is listed on the liabilities side.

Conservative Enterprise

Limited.

Balance Sheet as at 31st

March 2017

|

|||||

Assets

|

Liabilities

|

||||

Fixed

Assets

|

3000

|

Capital

|

500

|

||

Reserves

|

5000

|

||||

Net Worth

|

5500

|

||||

Loans

|

0

|

||||

Inventory

|

150

|

||||

Receivables

|

1500

|

Trades

payable

|

500

|

||

Cash

& Cash Equivalents

|

1350

|

||||

Total

Assets

|

6000

|

Total

Liabilities

|

6000

|

||

Of course in terms of priority in repayment, in the event of liquidation of the business, capital comes last. This means that when a business is being wound-up, the assets of the business are sold and the proceeds are utilised to repay the sums owed to various parties, including the owners/ shareholders, in the following order of priority:

Informative Topic. Thanks for this Blog. If you want to get Accounting and Bookkeeping services, Visit https://bigbracketuae.com/

ReplyDelete