There is no good time or bad time for investing. We have to find good stocks at the right price in the market and invest.

Honestly speaking, as the economy is turning around, the stock market is rising and stock have become expensive to buy and I am unable to find enough good stocks at the right price.

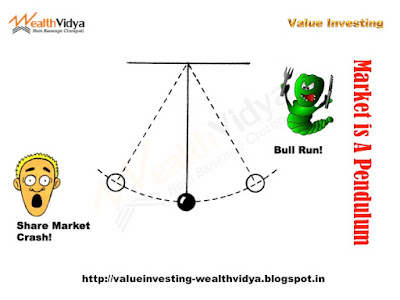

Contrary to what most people think, when the economy is in the upswing is NOT the right time to invest. The right time to invest is actually when the economy is in doldrums or shattered - that is when we should have the courage to make massive investments - they will payoff handsomely!

So what shall a person do when economy and markets are booming?

- Search, find and make humble investments every month in good stock priced right.

- Deeply and carefully study and shortlist great companies, which are expensive right, to make investments in future, when the market crashes.

- Accumulate cash - keep ready a war-chest - for that doomsday.