Prama-Facie Observations:

Ramco Systems’ scrip does not justify inclusion in a value

investing portfolio.

Why?

Let us investigate.

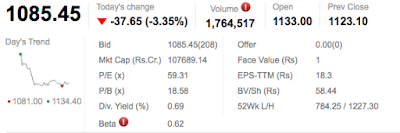

Please closely examine the following picture.

|

| Picture Shows Ramco Systems Share's Market Snapshot |

Critical Remarks:

- PE Ratio: Ramco’s PE Ratio is 42.31 whereas the maximum acceptable number is 15 and the best for Indian conditions is 10.

- P2BV Ratio: Exceeds the recommended 1.50 times the book value.

- Distance from 52 week low: On this parameter the scrip is in safety zone – it is not very far away from the 52 week low – a mere 6.28% to be precise.

- Dividend Yield: Zero percent compared to the recommended five percent asnd above.

In light of the above the scrip shall be rejected.

Profitability Analysis:

|

Ramco Systems Ltd.

|

(Rs in Crores [10

million])

|

||||

|

Profit and Loss Accounts

|

Mar ' 16

|

Mar ' 15

|

Mar ' 14

|

Mar ' 13

|

Mar ' 12

|

|

Income

|

|

|

|

|

|

|

Operating income

|

262.66

|

222.97

|

160.81

|

169.09

|

151.82

|

|

Expenses

|

|

|

|

|

|

|

Material consumed

|

2.1

|

0.96

|

2.03

|

7.67

|

1.35

|

|

Manufacturing expenses

|

0

|

0

|

0

|

0

|

0

|

|

Personnel expenses

|

104.26

|

92.42

|

74.28

|

88.83

|

71.8

|

|

Selling expenses

|

0

|

0

|

0

|

0

|

0

|

|

Adminstrative expenses

|

81.35

|

73

|

61.89

|

59.03

|

57.4

|

|

Expenses capitalised

|

0

|

0

|

0

|

0

|

0

|

|

Cost of sales

|

187.71

|

166.38

|

138.19

|

155.53

|

130.55

|

|

EBDITA

|

74.95

|

56.59

|

22.62

|

13.56

|

21.28

|

|

Financial expenses

|

3.57

|

12.01

|

11.45

|

6.05

|

2.56

|

|

Depreciation

|

45.46

|

44.45

|

37.12

|

32.4

|

27.34

|

|

EBT

|

25.92

|

0.13

|

-25.95

|

-24.89

|

-8.62

|

|

Other write offs

|

0

|

0

|

0

|

0

|

0

|

|

Other recurring income

|

4.6

|

1.79

|

6.67

|

6.08

|

5.66

|

|

PBT

|

30.52

|

1.93

|

-19.28

|

-18.81

|

-2.96

|

|

Tax charges

|

6.51

|

0.38

|

0

|

0

|

0

|

|

PAT

|

24.01

|

1.56

|

-19.28

|

-18.81

|

-2.96

|

|

Non recurring items

|

0

|

0

|

0

|

0

|

0

|

|

Other non cash adjustments

|

0

|

0

|

0

|

0

|

0

|

|

Reported net profit

|

24.01

|

1.56

|

-19.28

|

-18.81

|

-2.96

|

|

Earnigs before appropriation

|

-57.61

|

-81.62

|

-82.27

|

-63

|

-44.19

|

|

Equity dividend

|

0

|

0

|

0

|

0

|

0

|

|

Preference dividend

|

0

|

0

|

0

|

0

|

0

|

|

Dividend tax

|

0

|

0

|

0

|

0

|

0

|

|

Retained earnings

|

-57.61

|

-81.62

|

-82.27

|

-63

|

-44.19

|

|

EBDITA % to Sales

|

28.53%

|

25.38%

|

14.07%

|

8.02%

|

14.02%

|

|

EBT % to Sales

|

9.87%

|

0.06%

|

-16.14%

|

-14.72%

|

-5.68%

|

|

PAT % to Sales

|

9.14%

|

0.70%

|

-11.99%

|

-11.12%

|

-1.95%

|

Remarks:

- EBDITA margins are decent even though you can get many excellent companies posting 50% and above EBDITA margins still available at PE Multiples of below 10.

- The company has suffered losses for three years from financial years (FY) 2012 to 2014. In FY 2014 a marginal profit was made. In FY 2015 somewhat acceptable EBT margins are shown but not good enough. A value investor can only pick a stock that has shown consistent and handsome profits for at least 10 to 15 years.

- Under the circumstances the scrip does not qualify inclusion in the portfolio with respect to profitability parameter.

Dividends:

In

the last five years the company has not paid a penny by way of dividend. Of

course it had not made profits and therefore it could not pay. But as far as

the investor is concerned he or she is rightfully entitled annual dividend for

the investment. After all ‘dividends are rightful wages of investors’.

Actually

to be selected for investment a stock should have paid dividends as long as

possible without break but at least for fifteen years in the past. Therefore

Ramco clearly fails in this test.

Five-year price graph:

|

| Five-year Price Graph of Ramco Systms Share |

The

graph above shows that the stock price having remained muted for two years

suddenly springs-up to life and steeply climbs from Rs.200 to over Rs.1000 apiece.

What

to make out from this?

- Probably on the back of losses the share was languishing at about Rs.200 levels.

- The moment profits were visible in FY 2013-14 optimists have started showing extreme enthusiasm for the scrip and taken it to the level of Rs.500.

- During FY 2015-16, the optimists’ enthusiasm has reached a crescendo with the price crossing Rs.1000 mark.

- In the final analysis optimistic investors seem to have put Ramco in the league of other information technology behemoths and have given Ramco similar PE Multiple.

- In a remote yet plausible case, perhaps a few strong market players are taking the price up and when they decide to sell, after it has reached a certain level, the fringe players could be awfully stuck.

Final Conclusion:

On

account of losses till recently, non payment dividends, lack of proven dividend

track record, high PE and P2BV Multiples, zero dividend yield and so on, in the

present day Ramco Systems Ltd.’s shares are not justified for inclusion in a value

investor’s portfolio. Maybe after a few years the scrip may be revisited and it

sustains profits and starts paying dividends and various parameters justify it

may be included, but certainly not today.

Important Notice:

Kindly note that

this is a very superficial analysis of the company as he results of such a

preliminary study do not justify any further investment of time for an in-depth

analysis at this stage.