|

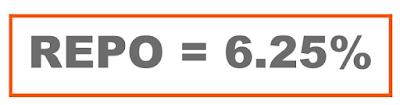

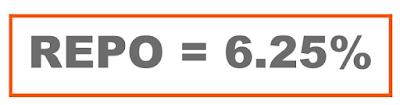

| India'a Current Repo Interest Rate stands at 6.25% |

Repo rate is the most important monetary policy tool in the

hands of the central banks.

An increase in Repo Rate reduces inflation.

How?

An increase in Repo Rate will make borrowing for commercial

banks costly and therefore in turn they are forced to increase their lending

rates. This will increase the borrowing costs of business and industry and they

tend to curtail fresh investments. This in turn reduces the incomes of people

who would have executed those expansion plans. This reduced income lowers the

demand for consumption goods and consequently brings down the prices of these

commodities. Lower commodity prices result in lower inflation.

This is how macro economics work or at least supposed to work.

The opposite happens if the Repo Rate is reduced - it spurs

growth and inflation tends to go up.

In conclusion central banks increase Repo Rate if they want to

tame inflation and reduce it if they want to spur growth.

The Reserve Bank of India (RBI) in its latest review meeting,

contrary to wide expectations that the Repo rate will be reduced by 25 basis

points, maintained the Repo rate at 6.25% indicating that it believes that any

reduction would stoke inflation.

Suggested Further Study:

- What Is Basis Points?

- Yield Definition

- Yield Slide

- What is the Relationship Between a Bond's Market Price

and Its Yield to Maturity?

- What Is Internal Rate of Return or IRR In Simple Terms?

- Value

Investing