Pages

- Home

- New WordPress Blog

- What is Value Investing?

- Portfolio 2K15

- Research Reports

- Videos

- Books

- Definitions - Investing

- Accounting and Financial Terms

- Formulae

- Calculator

- "How To?" Artciles

- "What Is?" Articles

- Slides/ Presentations/ Pictures

- Questions and Answers

- Warren Buffett's Inspirational Quotes

- Poems

- Investing Jokes

- Games

- Audience Speak

- Tweets

- Forum

- News

- Accreditations

- Website

- Contact

Quick Links

- New WordPress Blog

- Net Block (Fixed Assets) Definition

- Total Outside Liabilities to Tangible Net Worth (TOL/ TNW) Formula

- How to Navigate Turbulent Stock Markets?

- Why Mutual Fund Returns Dip?

- Is the Stock Market a Place to Make a Fast Buck?

- How to Find the Fair Price of A Stock?

- How to Calculate the Intrinsic Value of Shares?

- Price to Book Value Ratio - Formula

- Debt Equity Ratio - Formula

- Total Outside Liabilities to Tangible Net Worth (TOL/ TNW) Formula

Sunday, April 30, 2017

Principles are Eternal

Labels:

outdated,

principles,

Quotes,

short posts

Dividend Yield Calculator

How to Use the Calculator:

- If you are in the 'Home' page, please Click on the post title to enter the 'Post Page' and proceed.

- Please Wait for the calculator/ excel sheet to load - it may take a minute depending on the speed of your internet connection.

- Please study the post/ article "What is Dividend Yield?" for proper prior understanding.

- Please enter your values for 'Current Market Price (CMP)' and 'Dividend Per Share'.

- Please input your values only in the designated cells (filled with yellow) in the excel sheet. All other cells are protected and are not intended to be altered.

- To clear the contents of the designated cells please refresh the page.

- This dividend yield calculator is currency neutral - that is it can be used for any currency.

Warren Buffett on Economi Cycles Video

|

Duration:

|

0:2:50

|

|

Producer:

|

Georgetown University

|

|

Audience:

|

Students of Georgetown University

|

|

Participants:

|

1.

Warren Buffett

2.

Briyan Moynihan, CEO, Bank of America

|

|

Year:

|

September 27, 2013

|

|

Description:

|

Noted

businessman, investor and philanthropist Warren Buffett joined Bank of

America CEO Brian Moynihan in Gaston Hall at Georgetown.

|

Labels:

Economic Cycles,

Videos,

Warren Buffett

Saturday, April 29, 2017

How to Allocate Funds Among Pre-Selected Stocks?

Actual Question:

I like your model of picking the

shares. Can you also suggest how to rank among those eight you have

shortlisted? If some one has to invest say Rs.5,00,000 - how do they distribute? Thanks in advance.

Answer:

Dear Friend!

The selected eight stocks are as

follows:

Answer:

This answer is sort of a sequel

to the previous question “What Stocks to Buy when the Market is at its Peak?”.

Therefore, those who have have not happened to read the previous article may

kindly read the previous post first and then read this present article.

- The eight stocks had been shortlisted based on following four criteria:

- Price to Book Value (P2BV) Ratio - must be less than or equal to 1.5

- Price to Earnings (PE) Ratio - should be less than or equal to 15

- The Combination/ Product of the first two - shall be less than or equal to 22.5 (1.5*15)

- Dividend Yield - More than or equal to 4%

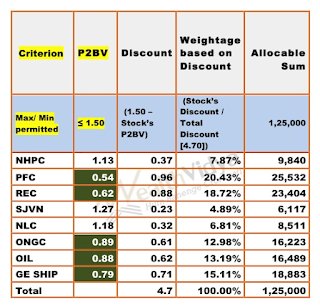

Let us apportion the Investible

sum of Rs.5,00,000 equally for the four criteria. This translates into

Rs.1,25,000 each.

We will allocate the sum of

Rs.1,25,000 to all the candidates based on the weights of available market

discount (how much less than maximum permitted 1.5).

For example for the first

criterion, the stock having the lowest price to book value will attract the

maximum allocation. Following table make the process clear:

Price to Book Value (P2BV) Ratio Criterion:

The same process is repeated for the the ‘PE’ and ‘P2BV*PE’ criteria also and the results are as follows:

Dividend Yield Criterion:

Please note that while shortlisting the eight stocks, we had already eliminated non-conforming stock under the first three criteria. Under the fourth and dividend yield criterion it is not fair to eliminate a stocks which otherwise shines on the other three prior criteria. The best you can do is do not allocate any funds to those stocks that whose dividend yield is below 4 or allocate only based on the weight.

To conclude, the investible funds are allocated amongst the pre-selected candidates based on the relative merits under the criteria of P2BV Ratio, PE Ratio, P2BV*PE Ratio and Dividend Yield.

Thank you,

With Best Regards

Anand

Equities are Best for People who Can Invest Over Time

Thursday, April 27, 2017

What Stocks to Buy when the Market is at its Peak?

Dear Friend!

Your question is a very

good one, as today the Indian markets are at their record highs. The Sensex is

above 30000 and the NIFTY is above 9300. An investor naturally wonders what

stocks to buy in India at these levels. Fortunately the key to this riddle lies

in the nature of the market itself. The stock market is an imperfect and

irrational one. Because of this imperfect market behaviour, a value investor

mostly is able to find good opportunities to invest in wonderful stocks at

reasonable prices.

Let us see the good

stocks that are still available at attractive valuations even when Indian

markets are at record highs:

The dividend yields of

SJVN, NLC and GE Ship are slightly below the minimum dividend

yield expectation but their Price

to Book Value Ratios and Price

to Earnings Ratios are in the attractive zone.

In conclusion, in the imperfect stock markets an investor usually is in a position to buy good stocks even when the markets are at their peaks.

Thank you,

Best Regards,

Anand

Subscribe to:

Comments (Atom)