Meaning and Definition:

Balance Sheet, also known as the ‘Statement of Affairs’, is

the first and the most important of the three financial statements, the other

two being the ‘Profit and Loss Account’ and ‘Cash Flow Statement’. It lists the

assets and liabilities of a business as on a particular date.

The assets and liabilities in the statement of affairs

balance-out each other and hence the name ‘Balance Sheet’.

|

| Picture shows a weighing scale where assets and liabilities balance-out each other |

Example:

|

The Great Eastern

Shipping Company Ltd.

Balance Sheet as on 31st

March 29016

|

|

Liabilities

|

Rs. in Crores (Rs. 10 million)

|

Assets

|

Rs. in Crores (Rs. 10 million)

|

|

Current Liabilities:

|

|

Current

Assets:

|

|

|

Short-Term

Borrowings

|

0.00

|

Cash

And Bank Balances

|

2,624.98

|

|

Sundry

Creditor (Trade)

|

1,223.62

|

Current

Investments

|

877.97

|

|

Other

Current Liabilities

|

1,057.59

|

Sundry

Debtors (Trade Receivables)

|

320.56

|

|

Short Term Provisions

|

1,098.62

|

Inventory

|

113.23

|

|

|

|

Short

Term Loans and Advances

|

90.15

|

|

|

|

Other

Current Assets

|

114.96

|

|

Total

Current Liabilities

|

2,379.83

|

Total Current

Assets

|

4,141.85

|

|

|

|

|

|

|

Term

Liabilities:

|

|

Non-Current Assets:

|

|

|

Debentures

|

0.00

|

Fixed

Assets:

|

|

|

Term

Loans

|

4,930.21

|

Tangible

Assets

|

10,652.35

|

|

Long

Term Provisions

|

37.61

|

Intangible

Assets

|

0.63

|

|

Other

Term Liabilities

|

0.00

|

Capital

Work-in-progress

|

365.34

|

|

Total

Term Liabilities

|

4,967.82

|

Total Fixed Assets

|

11,018.32

|

|

Total

Outside Liabilities

|

7,347.65

|

Non-Current

Investments

|

0.00

|

|

|

|

Deferred

Tax Assets (Net)

|

0.57

|

|

Net

Worth (Shareholders’ Funds):

|

|

Long

Term Loans and Advances

|

44.51

|

|

Ordinary

Share Capital

|

150.78

|

Other

Non Current Assets

|

426.30

|

|

Reserves

& Surplus

|

8,133.12

|

|

|

|

Net

Worth or Net Assets

|

8,283.90

|

Total Other

Non-Current Assets

|

471.38

|

|

Total Liabilities

|

15,631.55

|

Total Assets

|

15,631.55

|

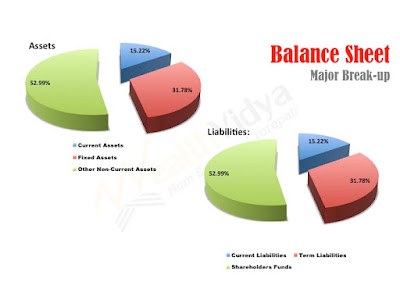

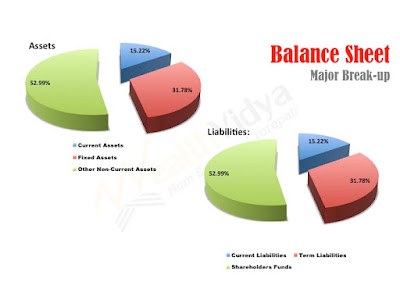

Major Break-up of Assets and Liabilities:

|

| Pie0chart depicting major break-up of assets and liabilities |

When

total outside liability, that is money owed to outsider or people other than

shareholders, is deducted from total assets, we get the net assets or shareholders’ funds. It is also called net worth and belongs to the

shareholders who have invested their money in the business.

In

the balance sheet of the company or business it is shown as a liability because

the shareholders and the business are technically different and separate and

the business owes the net worth to the shareholders.

The

net assets or the net worth primarily grows out of profits generated by the

company.

More

the assets and lesser the outside liabilities better it is for the

shareholders, as the net assets or the net worth belongs to them.

Conclusion:

Balance Sheet is the most important financial statement. All others support the balance sheet. It lists the assets owned by liabilities owed by a business.

Further Related Reading: