This

month we have liberalised the rules for buying stocks a bit.

Why?

The

market sizzling and making stocks highly expensive across the board, and if we

don’t loosen a bit we will not be able to:

- Buy anything

- Do justice to some of the good stocks that had suffered price hammering in the global commodity markets.

We

have set a liberalised yet strict rules that besides being a member of our ‘Portfolio 2K15’, the stocks shall

satisfy the three criteria prescribed below:

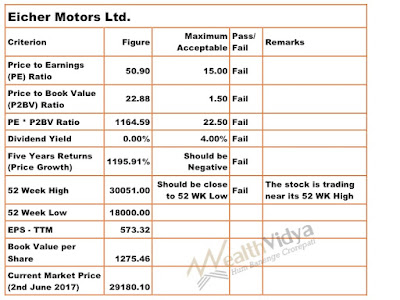

- The Price to Book Value (P2BV) Ratio shall be less than 1.50. This means we will allocate money to a stock under this rule to only those stocks that are available at or at a discount to the price to book value ratio of 1.50. This is liberalisation from a stringent 1.00 earlier.

- The Price to Earnings (PE) Ratio shall be below 15. This is again liberalisation from the tough hurdle of 10 earlier.

- The product/ combination of PE*P2BV shall be less than 22.50 (1.5*15)

- The Dividend Yield shall be more than 0%. However, a mere good dividend yield is not sufficient. In addition, the scrip must have passed at least one of the three previous tests. Meaning if the share proves expensive under the P2BV, PE and PE*P2BVcriteria, it is ineligible for allocation merely on the grounds of an attractive dividend yield.

The

total investible sum is taken as multiples of 10,000, that is Rs.20,000, 40,000

or 120,000 and so on, depending on the investible surplus available with the

investor.

The

basic unit of 10,000 is equally distributed among the four criteria at Rs.2,500

each or multiples thereof.

This

month all the stocks constituting our Portfolio

2K15 qualified, however MOIL Ltd., though managed to qualify after many

months, could not earn enough allocation even to buy a single share!

Summary:

Now let us examine the eligible candidates separately under each

of the three criteria in detail.

Price to Book Value

(P2BV) Ratio: