Actual Question:

What is meant by ledger balance in SBI trading account?

Answer:

Dear Friend!

Thank you very much for considering me fit to seek advice.

Your question is too short and not fleshed with other

contextual material. Still I will try to answer your question to the best

extent and context I have understood.

Usually the various steps involved in executing a trade are

as follows:

- First we transfer funds into the trading account, say Rs.15,000/-, from the linked bank account - for example, in my case the trading account is with Kotak Securities and the linked bank is Kotak Mahindra Bank.

- Now the ledger balance in the trading account is Rs.15,000/- Cr (meaning amount is due to you).

- Now you place an order to buy say 20 shares of Great Eastern Shipping at Rs.433/-. The total value of the order translates into Rs.8660/-.

- Now the ledger balance should show Rs.6,340/- Cr (due to you).

- Let us assume that next you buy 50 shares of Rural Electrification Corporation (REC) at Rs.180/- a piece for a total value of Rs.9000/-.

- Now the ledger balance should show Rs.2,660/- Dr (Due to the Stock Broker Firm).

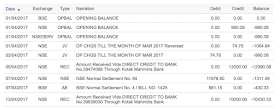

Please look at the actual trading account ledger balance of Kotak Mahindra Bank for April 2017:

In

conclusion, the trading account ledger balance is the final amount due to or

from an individual after various transactions during a certain period.

I hope I

was able to answer your question adequately.

Thank you,

With Best

Regards

Anand

I really found very interesting about these topic because you have good content and unique thoughts on writing. So this might be useful to everyone. I really look forward some more updates. Thanks for sharing.

ReplyDeleteCommodity Advisory Firm Indore

is stock broker firm charging for this funding from them?

ReplyDeleteIn the reply it's explained in the example that after buying the first set of Shares the Account balance becomes Rs.6340/- only. Then how is it possible to buy the second set of Shares for Rs.9000/- when your Credit Balance in Account is lower than the price? I didn't understand that. Will the Stock Broker Firm lend mony to us in such a situation? Please explain.

ReplyDeleteYour stock broker company lends you some amount of money (Margin Debit) depending upon your daily trading and your stock portfolio. They have their formulas to calculate the amount of money which they can lend you.

DeleteFor instance, they won't lend you INR10,000 if your trading account has just INR200 in it.

This comment has been removed by the author.

ReplyDeleteSir my leader balance is showing negative balance means

ReplyDelete