Value

Investment Analysis Report

26th December 2016

Basic Filtering Criteria:

|

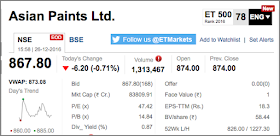

| Asian Paints Share's Market Snapshot |

Critical prima-facie Observations of Asian Paints Limited:

- PE Ratio: Asian Paint’s PE Ratio is 47.42 is well above the maximum permitted 15 and the Ideal for Indian conditions of 10 and therefore makes it highly expensive!

- Price to Book Value Ratio: At 14.84 as against the permitted 1.5 again makes the share unaffordable to buy.

- Distance from 52 week low: The current price of Rs.867.80 is just 5% away from the 52 Week Low of Rs.826. On this parameter the market condition of the scrip is favorable.

- Dividend Yield: A dividend yield of 0.87% is very low.

In light of

the above conditions, where three out of the four parameters are unfavorable,

under normal circumstances Asian Paints shall be dropped without any further

study. But considering that the company is no doubt a market leader and a

strong brand in India and further considering that the market has valued the

share so highly, we make an exception and undertake limited further study.

A. Company Performance

Profitability Analysis

Asian

Paints Consolidated

Profit and Loss Account

(Rs. in Crores)

|

March 31' 2016

|

Net

sales

|

15,534.14

|

Cost of sales:

|

|

Purchase

of Stock in Trade

|

723.20

|

Changes

in Stock of WIP & FG

|

171.30

|

Personnel

Expenses

|

1017.84

|

Other

Expenses

|

3502.09

|

Depreciation

|

287.97

|

Interest

|

40.51

|

SUB-TOTAL

|

13054.00

|

Operating

profit after interest

|

2,480.14

|

Net

Non-operating income

|

148.27

|

Profit

Before Tax

|

2628.41

|

Provision

for taxes

|

849.14

|

Profit

After Tax (PAT)

|

1779.27

|

EBDITA

(Operating Profits)

|

2808.62

|

EBDITA

(Operating Profits) %

|

18.08%

|

Depreciation

|

287.97

|

EBITA

|

2520.65

|

EBITA

%

|

16.23%

|

Interest

|

40.51

|

Interest Cost to Sales - %

|

0.26%

|

EBT

|

2480.14

|

EBT

%

|

15.97%

|

Net

Non-Operating Income

|

148.27

|

FINAL

PBT

|

2628.41

|

FINAL

PBT %

|

16.92%

|

Income

Tax

|

849.14

|

PAT

|

1779.27

|

PAT

%

|

11.45%

|

Remarks:

- Asian Paints’ EBDITA and other profitability margins are respectable but nothing great to command such high market valuations

- Interest cost is an insignificant at 0.26% of revenues, which shows that the company has followed a prudent, low debt business model.

- Net non-operating income constitutes a mere 5.98% of operating profits (EBT), which means that there is little cushion other than operating profits to service dividends.

Balance Sheet Analysis:

Asian

Paints Consolidated

Balance

Sheet

(Rs. in Crores)

|

March 31' 2016

|

LIABILITIES

|

|

Short-term

borrowings

|

231.08

|

Sundry

creditor (Trade)

|

1590.10

|

Other

current liabilities & provisions

|

1,995.25

|

Total

Current Liabilities

|

3,816.43

|

Term

loans

|

74.91

|

Deferred

Tax Liability

|

217.60

|

Long

Term Provisions

|

124.36

|

Minority

Interest

|

294.21

|

Other

term liabilities (Advances from Customers)

|

10.57

|

Total

Term Liabilities

|

721.65

|

Total

Outside Liabilities (TOL)

|

4,538.08

|

Ordinary

share capital

|

95.92

|

Reserves

& Surplus

|

5509.33

|

Net

Worth

|

5,605.25

|

Total

Liabilities

|

10,143.33

|

ASSETS

|

|

Cash

and bank balances

|

420.43

|

Current

Investments

|

1558.94

|

Trade

Receivables

|

1248.26

|

Inventory:

|

2064.00

|

Other

current assets

|

569.00

|

Total

Current Assets

|

5,860.63

|

Fixed Assets - Net Block

|

3074.59

|

Capital Work in Progress

|

110.80

|

Total

Fixed Assets

|

3185.39

|

Non Current Investments

|

539.25

|

Long Term Loans & Advances

|

179.32

|

Deferred Tax

|

0.51

|

Other non-current assets

|

49.75

|

Total

Other Non-Current Assets

|

768.83

|

Intangible Assets

|

130.82

|

Goodwill On Consolidation

|

197.66

|

Total

Assets

|

10,143.33

|

Tangible Net Worth

|

5,276.77

|

Current

Ratio

|

1.54

|

Total

Outside Liabilities/ Tangible Net Worth (TOL/ TNW)

|

0.86

|

Total

Long Term Liabilities/Tangible Net Worth

|

0.14

|

Highlights:

- Though the interest cost as a percentage of sales is negligible, Asian Paints is not totally debt-free. We wonder why it is so.

- Current Ratio is below the recommended two and above at 1.54.

- TOL/ TNW ratio is well below the maximum prescribed 3.

- Long-term Deb-Equity ratio is also well less than the recommended not more than 1.

Therefore on the balance sheet front Asian Paints is strong.

Cash Flow Analysis

Asian Paints Limited.

Cash Flow Statement

(Rs. in Crores)

|

March 31' 2016

|

Cash

Flows from Investing Activities

|

|

Net

Cash Flows from Operating Activities as Reported

|

2333.28

|

Finance

Cost

|

-40.09

|

Adjusted

Cash From Operations/ Free Cash flows

|

2293.19

|

Face

Value

|

1.00

|

Number

of Equity Shares

|

95.92

|

Free

Cash Flows / Share

|

23.91

|

Free

Cash Flows / Share as % of Market Price

|

6.47%

|

Cash

Flows from Investing Activities

|

|

Purchase

of Fixed Assets (Net)

|

-824.43

|

18.51

|

|

Sale/

(Purchase) of long-term investments

|

-113.65

|

Sale/

(Purchase) of short-term investments

|

35.87

|

Fixed

Deposits

|

-70.15

|

Interest

and Dividend Income received

|

84.71

|

Total

Net Cash Flows from Investing Activities

|

-869.14

|

Cash

Flows from Financing Activities:

|

|

Loans

Raised/ (Repaid)

|

-113.86

|

Equity

Buyback

|

|

Dividends

Paid

|

-764.23

|

Dividend

Distribution of free cash flows

|

33.33%

|

Total

Cash Flows from Investing Activities

|

-878.09

|

Net Increase/

Decrease in Cash for the year

|

545.96

|

Highlights:

- Asian Paints is generating decent amount of free cash flows from its operations.

- Free cash flows per share constitute a mere 6.47% of the current market price of the share, which means that it is going to take more than 15 years for the company to earn back what you invest to buy the share today. Actually it is not the fault of the company but that of the market, which has made the share so expensive

- Again even though the company is distributing a handsome portion (33.33%) of its free cash flows as dividends, the steep market price of the share has pulled down the dividend yield to below 1%

- A respectable proportion of free cash flows is being invested in new fixed assets that can be expected future boost sales and profits.

On the cash flows front Asian

Paints’ performance is good.

Dividends

Distribution of net Profits

Let

us study the dividend distribution pattern of Asian Paints:

Mar ' 16

|

Mar ' 15

|

Mar ' 14

|

Mar ' 13

|

Mar ' 12

|

|

Dividend payout ratio (net profit)

|

45.03

|

44.08

|

43.48

|

42.02

|

40.03

|

Dividend payout ratio (cash profit)

|

39.18

|

37.73

|

36.80

|

37.48

|

36.26

|

So,

on this count company performance is good.

Uninterrupted Dividend Payment History

Year

|

2016

|

2015

|

2014

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

2004

|

2003

|

2002

|

2001

|

2000

|

1999

|

1998

|

1997

|

The

above table shows uninterrupted dividend payment for the last 20 years.

On the uninterrupted dividends payment front Asian Paints has an

excellent track record.

Dividend

Yield:

Dividend

Yield is a combination of both the company’s dividend policy and performance as

well as market condition. A dividend yield of 0.87% is poor, but this lower

yield is primarily on account of high market price of the share.

Five-year price graph:

|

| Graph Depicts Asian Paints Share's Five Year Price Movements |

From

the graph we can see that the market has been chasing this scrip for the past

five years, pushing the price from around Rs.270 in June 2012 to the current

level of Rs.867, a whopping 221%.

In conclusion the five year price graph of Asian Paints shows that

presently the share is closer to it’s

five year peak and this is not a favourable market condition for buying the

stock.

Five

years returns (price rise):

|

| Picture Shows the Five Year Returns (Price Gains) of Asian Paints' Share |

The

five years return of Asian Paints share

reveals a return (price increase) of 225.86%. It indicates that the price of

the share has appreciated significantly in the past five years.

Therefore the market condition

under this parameter too is not very favourable.

Distance from 52-Week Low:

52-Week Low: Rs.826

52-Week

High: Rs.1,227.30

Current

Market Price (CMP) on 26th December 2016: Rs.867.80

The current price of Rs.867.80 is just 5.06% away from the 52

Week Low of Rs.826.

On this

parameter the scrip is favorably placed. How? The price corrected more than 25%

in the last quarter. Still overall the share is still very expensive.

Final Conclusions:

- Asian Paints is without doubt a great company with market leadership and strong brand value. It will shine in any value investor’s portfolio.

- The EBDITA, EBT and PAT margins are decent but nothing to brag about. The company is consistently profitable for many years into the past.

- Current Ratio is a bit weak but TOL/ TNW and Long-term Debt-Equity Ratio are strong.

- Free cash flows are good and well deployed.

- PE Ratio of 47.42 makes the share highly expensive.

- Price to Book Value Ratio (P2BV) of 14.84 again makes the share very expensive and unaffordable.

- The market condition parameters of five-year price graph and five year returns do not favour buying the share presently.

- Though the company is distributing a good proportion of the profits as dividends, the high market price has pulled down the dividend yield.

Final Investment Advice:

- Asian Paints is a good company.

- Market price is too high.

- Only during post Lehman Brothers bank collapse like situations will the price come down. Even then it will never come down enough to bring down below a PE of 15 and P2BV of below 1.5. Buy the Shares of Asian Paints only during such times. Certainly not now.

Post Disclaimer: Opinions expressed here are the author’s personal opinions. Market conditions have a great bearing on many end results discussed in this report. No disrespect is intended towards the company, it’s management. Investors are advised not rely blindly on the opinions expressed herein but to exercise their own judgment. Neither the author nor the blog shall be responsible for any loss suffered by either acting or not acting based on the opinions expressed herein.

No comments:

Post a Comment