Investors look forward to credible stock market tips at the beginning of every month for investing. The stock news is full of junk tips from equally rubbish quacks. So what the investors are looking for is credible stock recommendations. So, as usual, I write this monthly article providing reliable stock market tips based on sound logic.

This month, October 2017, I have liberalised the rules for buying stocks a bit.

Why?

Because the market is too hot. Perhaps there is excess liquidity in the market? Of course there have been a few crashes in September but still, the stock market is at a high. The scorching markets have made stocks expensive across the board. And if we don’t make the belt loose we will not be able to buy any stocks and do justice to the good companies listed in the ‘Portfolio2K15‘.

As in the last month, I have tightened the dividend yield criterion this month too. But unlike last month, this month I set a hurdle rate of a minimum 4.00% dividend yield. Only those stocks that jump over this hurdle will get allocation under this category.

I have set a liberalised yet strict rules such that besides being a member of our ‘Portfolio 2K15’, the stocks shall satisfy the four criteria prescribed below:

- The Price to Book Value (P2BV) Ratio shall be less than 1.50. This means we will allocate money to a stock under this rule to only those stocks that are available at or at a discount to the price to book value ratio of 1.50. This is liberalization from a stringent 1.00 earlier.

- The Price to Earnings (PE) Ratio shall be below 15. This is again liberalization from the tough hurdle of 10 earlier.

- The product/ combination of PE*P2BV shall be less than 22.50 (1.5*15)

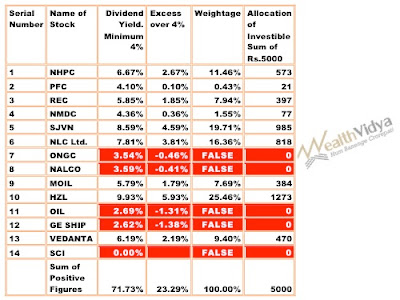

- The Dividend Yield shall be more than 4.00%. This is tightening from the last month’s 3.50%. Further, a mere good dividend yield is not sufficient. In addition, the stock must have passed at least one of the three previous tests. Meaning if the share proves expensive under the P2BV, PE and PE*P2BV criteria, it is ineligible for allocation merely on the grounds of an attractive dividend yield.

The total investable sum is taken as multiples of 20,000, that is Rs.20,000, 40,000 or 120,000 and so on, depending on the investible surplus available with the investor.

The basic unit of 20,000 is equally distributed among the four criteria at Rs.5,000 each or multiples thereof.

Summary of Stock Market Tips/ Recommendations

This October 2017 all the stocks constituting our Portfolio 2K15 qualified, however National Aluminium Company Ltd., whose price had appreciated throughout September, though managed to qualify could not earn enough allocation even to buy a single share! On the other hand MOIL Ltd., which could not earn enough allocation for many months in past made the mark this month.

13 stocks qualify for investment in October 2017. An unlucky 13? Please don’t bother. I assure you that these 13 stocks will be the luckiest thing ever happened to you.

Stock Market Tips Based on Price to Book Value Ratio

Let us examine the stocks under the important price to book value ratio criterion.

Stock Recommendation Based on Price to Earnings Ratio

Please see the table depicting the stock recommendation based on price to earnings ratio criterion.

Stock Market Tips Based on PE x P2BV Criterion

The product of the price to earnings and price to book value ratios is also an important criterion. As per value investing principles, this number shall not be more than 22.5 (1.5 * 15). Let us see what stocks pass this test.

Stock Recommendation Based on Dividend Yield Criterion

The dividend yield is an important aspect in stock selection. Let us see how our stocks fare under this key criterion.

We see that five of the 14 stocks could not pass the hurdle.

Conclusion

To conclude my stock recommendation for this October 2017 is to buy the 13 stocks in the recommended numbers for each 20000 of your investment. Happy Deepavali and investing!