Pages

▼

Tuesday, February 28, 2017

Monday, February 27, 2017

Sunday, February 26, 2017

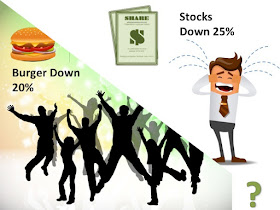

People Are Happy when Prices of Burgers Down But Not Stocks

|

| Picture shows people celebrating when burger prices are down but sad about stocks |

"This is one thing I can never understand. To refer to a personal taste of mine, I'm going to buy hamburgers the rest of my life. When hamburgers go down in price, we sing "Hallelujah Chorus" in the Buffett household. When hamburgers go up, we weep. For most people it's the same way with everything in life they will be buying - except stocks. When stocks go down and you can get more for your money, people don't like them anymore."

Warren Buffett

Wait for Your Pitch

Saturday, February 25, 2017

Investing Profits Games

|

| Picture Depicts Playing Games and Profits |

It is time to test our learning in a fun way. You are advised to read the profits related definitions like EBDITA, provided in the page 'Accounting and Financial Terms' before attempting to play this game.

This interactive investing and financial knowledge game is built over a protected MS Excel file. Please enter your answer (only numbers) in the green coloured boxes. Only these boxes are intended to input your answers. In case you attempt to alter any other cell you will receive an error message,

Refresh the page to clear the contents of the green coloured boxes.

Now, please have fun!

Price to Book Value Ratio Calculator

|

| Happy Investor Frog Explains Price to Book Value Calculation |

Meaning/

Definition:

‘Price to Book Value

(P2BV)’ is a measure of the number of times the book value of a share is

trading at in the stock market. The ratio or proportion is obtained by dividing

the ‘Current Market Price (CMP)’ of the share by its book value.

Significance:

Price to Book Value is the second most important metric in determining the

fair price of a share, the first being ‘Price to Earnings (PE) Ratio. If the

price is less than the book value it is a good bargain. Maximum recommended is

1.5 times, beyond which the price is not fair or reasonable.

Calculator:

Further Reading:

Friday, February 24, 2017

Tuesday, February 21, 2017

Is there a Legal Cap on Bond Rates?

|

| Picture portrays bond and wonders about rate cap |

Actual Question:

What is the maximum interest rate and minimum interest

rate for issue of debentures?

Answer:

Dear Friend!

There are no laws or regulations that fix the minimum and

maximum interest rates for debentures or bonds; it is the market that determines them.

The debenture is a debt contract and the interest rate is one of

the contract terms. In a contract it is the mutual consent and acceptance that

matters.

In reality the interest rates of debentures are governed based

on following factors:

- Is it a government debt?

- If private debt is there a sovereign guarantee?

- Is it a secured or unsecured?

- What is the tenure or repayment period - short or medium or long?

- Credit Rating assigned by independent rating agency

- What are the prevailing market interest rates for similar instruments?

- What is brand value of the issuer - example TATA Steel

- There are many other factors that go into finalising the interest rate of the debenture. Finally whether the rate will be attractive to the investors and affordable to the investor are the key.

Thank you,

With Best RegardsAnand

Related:

- What Is Basis Points?

- What is Negative Interest Rate?

- What are Repo and Reverse Repo Rates?

- How Repo Rate Affects Debt Funds?

Monday, February 20, 2017

Distinction Between Trading and Investing

Actual Question:

What’s the difference

between stock trading, investing and real estate?

Answer:

The dictionary

meaning of the word ‘Investing’ is

putting money into financial schemes, shares, property, or a commercial venture

with the expectation of achieving a profit. Further drilling down reveals a few

other aspects like period of holding,

safety of principal, regularity, and so on.

|

| Picture depicts investor walking to the stock broker to purchase shares |

‘Stock Trading’ is buying shares or sticks with an intention of

profiting from the price fluctuations on the stock market. Stock trading is a

speculative activity and does not fit into the definition of investing.

|

| Picture shows a trader sitting before the computer trading in stocks |

Real estate investment

qualifies as investment though it has some fundamental drawbacks.

Following table brings out

the differences among the three: