Pages

▼

Wednesday, November 2, 2016

What is the Differences Between Fundamental and Technical Analysis?

Fundamental Analysis:

|

| Picture Depicts the Concept of Fundamental Analysis |

Fundamental analysis is a thorough analysis of company carried

out with the intention of buying the shares for long-term investment. It is

based on studying the profitability of the operations, assets and liabilities

position, cash flows, etc., going as far back into the past as possible. During

the process a number of important ratios as under are derived and used:

- Profitability Ratios: EBDITA, EBT, PBT and PAT margins.

- Liquidity Ratios: Current and Quick Ratios.

- Long term Leverage Ratios: Debt-Equity and TOL/ TNW.

- Market Conditions: PE Ratio, Price to Book Value, Dividend Yield, Distance fro 52 week-low. Five-Year Returns.

|

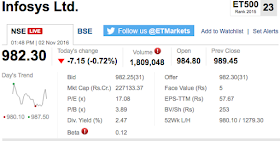

| Picture Shows Fundamentals of Infosy Share |

Technical Analysis:

Technical Analysis is the charting the price movements and

attempting to interpret short-term market behaviour of stock with intention of

making a profit from trading in stocks, commodities and currencies and their

derivatives.

|

| Candle Stick Chart of Infosys Ltd. Share from May to October 2016 |

Differences between Fundamental and Technical Analysis:

|

Differences Between Fundamental and

Technical Analysis

|

||

|

Sl. No.

|

Fundamental Analysis

|

Technical Analysis

|

|

1

|

Rational Science

|

Pseudo Science

|

|

2

|

Current Market Price is one of the inputs

|

Market prices and their movements is the only input –

facts relating company’s performance are not relevant

|

|

3

|

Used for evaluating fitness of stocks for long term

investment

|

Used for taking short terms positions

|

|

4

|

Does not involve market prediction

|

Prediction of future market behavior is the sole purpose

of technical analysis

|

|

5

|

Used by investors

|

Used by day traders and margin traders

|

|

6

|

Primarily intended for taking delivery of scrips

|

Not intended for taking delivery – trades are primarily

meant to be squared-off within the same day or by the end of the contract

period

|

|

7

|

Only relates physical shares

|

Primarily relates derivatives like futures and options but

also involves physical shares in the intra-day trading

|

Conclusion:

While fundamental analysis is an exacting and rational

discipline, technical analysis is a false study endeavouring to derive

legitimacy from the use of charts and graphs and the lofty sounding name.

Whatever realisation of predictions may be owing to the innumerable

practitioners acting according to the interpretation of the pattern and not

directly caused by the pattern – something akin to divination of future

employed in the ancient times.