Full Question:

Why is the Asian Paints

stock on a correction mode (down more than 10%) even after a positive Q2 result

and positive outlook? Is crude oil a factor?

Everything

seems positive. The market share seems intact. Then what’s the reason it has

seen a steep decline in valuation?

Is the

expected rise in crude oil prices a possible factor?

Or is

this a permanent correction in its valuation from overvalued levels (PE~50) to

more realistic levels?

Answer:

Dear Friend!

You have yourself hit the nail

on the head answered your question. Asian Paints Ltd., is wonderful company and

brand in a general sense (because of very high PE Ratio I had not invested my

time in deep study of the share) but the share is already overvalued as per value

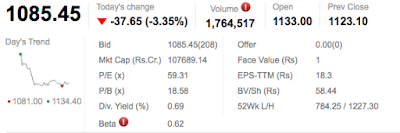

investing principles. Please see the following

picture:

Key Ratios:

Besides the high PE Ratio of

59.31 as against the recommended 10–15, which you have already identified

yourself, the Price to Book Value ratio is also very high at 18.58 times as

against the acceptable 1.5.

Dividend Yield:

The dividend yield is 0.69% as

against a minimum of 4–5%.

Distance from 52 week high:

Even after the correction the

current market price is still very near the scrip’s 52 week high!

Five-year returns:

The price of Asian Paints has

been continuously climbing for the last five years and the five-year returns or

price increase for this stock is 253%. Please see the price graph for this

scrip below:

Even though the price has

increased 2.5 times in the last five years the EPS has not grown at the same

pace - it has hardly grown 1.5 times - indicating that the market had raced

ahead of the earnings.

Market Nervousness:

As if all the above mentioned

headwinds are not enough the market is nervous after a steady gallop in the

Sensex in the last few months and in such situations the scrips that are

overpriced or over valued will correct first.

Conclusion:

Since the share is over valued

and the market is nervous after a trot in the last few months, Asian Paints’

share, in my opinion, has corrected recently and it may not be the end of the

road for the correction.